Iraq

Iraq is a country endowed with significant natural resources – holding the world’s fifth-largest proved oil reserves and twelfth-largest proved natural gas resources – with a large young population of 47 million (2025e), with about 65% of the population under the age of 30. The country’s potential was held back, and much of its infrastructure was destroyed by over four decades of conflict, starting with the Iraq-Iran War (1980-1988), the first Gulf War (1990-1991), the devastating 13 years of UN economic sanctions (1990-2003), the second Gulf War and the U.S. invasion (2003), which was followed by over a decade of civil strife marked by an anti-occupation insurgency, and civil war, that eventually led to ISIS occupying a third of the country in 2014, which culminated in three years of savage conflict that ended in 2018.

The end of the conflict heralded the beginning of the return of stability, and the country has since then enjoyed a period of relative stability. While these years were punctured by several shocks, such as the countrywide demonstrations in late 2019, the assassination of Iran’s top general in Baghdad, followed by the emergence of COVID-19 and the crash in oil prices in 2020, the undecisive elections in 2021, followed by a year of political impasse, topped by political conflict and violence in the summer of 2022. Nevertheless, these shocks were short-lived and did not lead to self-reinforcing cycles of violence and conflict along the lines of the past. As such, this relative stability provided a more stable and predictable macroeconomic framework for businesses and individuals to operate in and to plan for capital investments on a scale not seen in the last prior decades of conflict; that, in turn, should be sustained by the population’s pent-up demand for goods and services to catch up with the rest of the world.

The cumulative benefits of this relative stability were joined by a second driver of the country’s economic transformation, which was brought about by the Central Bank of Iraq’s (CBI) new procedural requirements for its provisioning of U.S. dollars for cross-border transfers in mid-November 2022. These, and the subsequent series of measures by the CBI and government throughout 2023, 2024 and 2025, are accelerating banking adoption instead of cash and informality that dominated the economy, thus bringing about a transformation of the sector and its role in the economy.

The country’s ongoing demographic shift, with about 65% of the 47 million (2025e) population, or 30 million (2025e), promises to bring with it a demographic dividend, to become a driver of economic growth, and will exert powerful pressures for much-needed economic reforms.

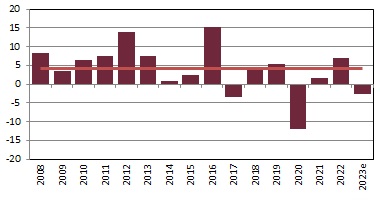

Iraq - GDP Growth Rate (%)

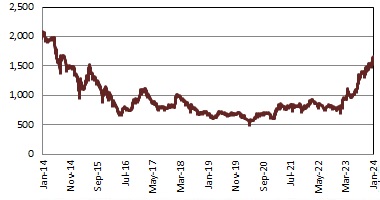

Iraq - Rabee Securities Equity Index

Stock Market:

The Iraq Stock Exchange (ISX), formerly the Baghdad Stock Exchange (BSE), is located in Baghdad and was established on 18th April 2004 and started trading on 24th June 2004. Trading opened to foreign investors in August 2007. The BSE was founded in 1991 and commenced trading in March 1992 with only one session a week and 64 listed companies by the end of 1992. The last trading day of the BSE was 19th March 2003, the day before the invasion of Iraq was launched. The ISX is a self-regulatory organisation governed by the Iraqi Securities Commission (ISC), modelled on the U.S. SEC. The exchange operates an electronic trading platform provided by NASDAQ-OMX, and the ISX currently lists 118 companies (including 14 companies traded on the OTC market) in various industries, including financial services, construction, agriculture, hotels and food processing. The ISX total market capitalisation was USD 18.6 billion as of January 2026, and trading is held from Sunday to Thursday. The market cap to GDP ratio is just over 5%, significantly lower than comparable countries in the MENA region, which have an average ratio of over 100%, which highlights the scope of potential developments for Iraq’s capital markets over the coming years.

Useful Links:

Iraq Stock Exchange website: www.isx-iq.net

The Iraqi Securities Commission website: www.isc.gov.iq

The Iraqi Depositary Centre website: www.en.idc-stocks.com

IRAQ

Population: 45.5 mn (2023e)

GDP: USD 269.6 bn (2023e)

Real non-oil GDP growth: 4.2% (2023 e)

- Population projected to grow by 16% to 52.8 mn by 2030

- Favourable demographics with 65% under the age of 25

- 5th largest proved oil reserves in the world

- 3rd largest oil exporter worldwide (2022)