Asia Frontier Capital (AFC) - October 2014 Newsletter |

||||||||||||||||

In this IssueAFC Asia AFC Vietnam Fund

|

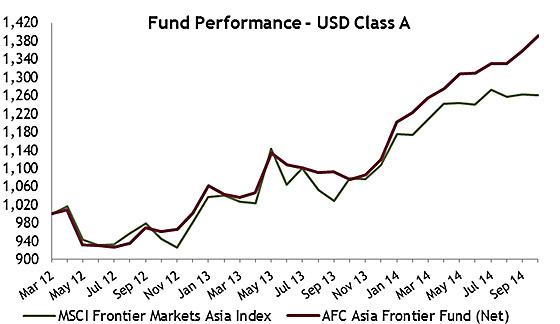

"We are what we repeatedly do. Excellence, In October 2014, the AFC Asia Frontier Fund returned +2.5% and AFC Vietnam Fund returned +2.8%, bringing the YTD total for our funds to +24.2% and +28.5% respectively. The MSCI World Index (+0.6%) and MSCI Emerging Markets Index (+1.1%) saw a bounce this month whilst frontier markets saw a broad decline. The MSCI Frontier Markets Asia Index (-0.2%) and MSCI Frontier Index (-4.5%) both lost ground and significantly underperformed the AFC Asia Frontier Fund. At the same time, the AFC Vietnam Fund outperformed both the Ho Chi Minh (+0.3%) and Hanoi (-0.7%) indices as the fund’s small and mid-cap strategy continues to bear fruit. Whilst neither of our funds is benchmark-constrained, both have outperformed their closest comparable indices since their respective inception dates. Looking at markets around the world, October’s historically excitable market temperament saw a great deal of volatility with the US and Europe experiencing a sharp decline followed by a rapid bounce back to close towards record highs set earlier in 2014. Whilst most investors holding a particular asset class are usually quite happy to hear that record highs have arrived, it is important to note that not all assets usually rally at the same time. The vast majority of the Asian frontier markets in which we invest are a long way from record highs, and some would have to go up by several multiples to reach their formerly lofty levels. Take for example the Vietnam Hanoi Index, which dropped by 80% from its peak in 2007 to its bottom in 2012. Today, the index would still need to go up by 4x to reach a new high, even after rallying +32.0% YTD! Whilst strong returns and protecting downside are obviously our key goals in managing AFC’s funds, the most important thing to remember for your personal portfolio is that the low correlation between Asian frontier markets and the rest of your holdings is one of the greatest benefits provided by our funds. The economies in which we invest are still primarily driven by domestic factors and are more isolated from external economic shocks due to low foreign participation. This makes logical sense, as the number of pairs of shoes bought by Bangladeshis, for example, has almost nothing to do with the political situation in the US, Europe, or Vietnam. Instead, it has a great deal more to do with increases in disposable income arising from participation in the formal economy, as millions of young people move from the countryside into the city to work. The AFC Asia Frontier Fund has had a correlation with the MSCI World Index and MSCI Emerging Markets Index of only 0.25 and 0.23 respectively since inception in March 2012. After the announcement of tapering in March 2013, these numbers have become even more pronounced and the fund has since had a correlation to these key global indices of -0.31 and -0.30 respectively. More information on this is available on pages 7, 8, and 32 of our presentation which you can access by clicking here. If you are interested to find out the extent to which our funds are correlated to any core asset classes in your portfolio, please be in touch with Stephen Friel at AFC NewsAFC in the Press Upcoming AFC TravelIf you will be in any of the locations listed below and have an interest in meeting with our team, please contact our Marketing Director Stephen Friel at

AFC Asia Frontier Fund - Manager Comment

AFC Asia Frontier Fund (AAFF) USD A-shares were up +2.5% in October 2014, outperforming the MSCI Frontier Markets Asia Index (-0.2%), the MSCI Frontier Markets Index (-4.5%) and the MSCI World Index (+0.6%). October saw a continuation of the good performance from last month which was again led by gains in companies which are not part of the fund’s relative benchmark, the MSCI Frontier Markets Asia Index. Our strategy of not being benchmark constrained and researching and investing in companies outside of the index has helped deliver solid performance over the past year. October saw a good all round performance across most of our top holdings in key markets. In Bangladesh, one of our consumer holdings continued to deliver returns as it remains undervalued relative to emerging market names. In Pakistan and Sri Lanka, a pharmaceutical company and a conglomerate, both Top 10 holdings, delivered solid returns during the month as the pharmaceutical company declared good quarterly results and the Sri Lankan conglomerate hived off a loss-making business which should lead to better returns for shareholders going forward. In Vietnam, returns were led by a consumer food, stationary and taxi company while in Cambodia, the fund’s holding in a gaming company continued another month of good performance. In October we added to existing positions in Bangladesh, Cambodia, Laos, Mongolia, Pakistan, Papua New Guinea Sri Lanka and Vietnam and we reduced one holding in Papua New Guinea. As of 31st October 2014, the portfolio was invested in 116 shares, 1 closed-end fund (with 27.1% discount to NAV), 1 GDR (with 65.2% discount) and held 8.0% in cash. The two biggest stock positions are a pharmaceutical company in Bangladesh (5.1%) and a pharmaceutical company in Pakistan (4.1%). The countries with the largest asset allocation include Vietnam (21.6%), Pakistan (18.4%) and Bangladesh (14.3%). The sectors with the largest allocation of assets are consumer goods (40.9%) and materials (13.5%). The weighted average trailing portfolio P/E ratio (only companies with profit) was 14.1x, the weighted average P/B ratio was 1.81x and the dividend yield was 4.14%. AFC Vietnam Fund - Manager Comment

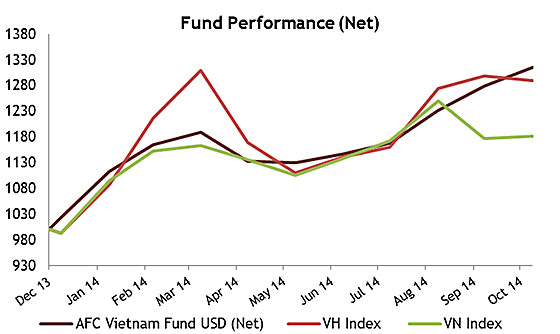

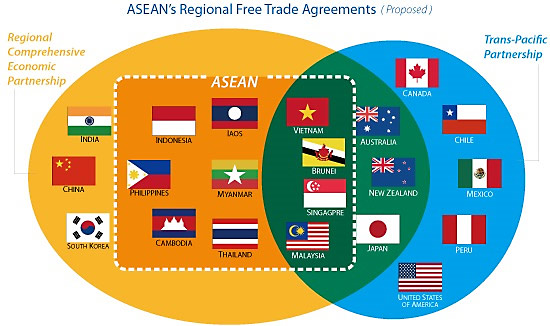

To read this month’s fund update in German please click here. In October 2014, the AFC Vietnam Fund returned +2.8%, bringing the total YTD return to +28.5%. October, which is historically the most volatile month for global stock markets, ended basically unchanged in Vietnam, despite a further interest rate cut. The Hanoi index lost -0.7% on a month-to-month basis and the Ho Chi Minh index gained +0.3%. While macroeconomic data continued to indicate a continuation or even acceleration of an economic recovery, corporate earnings growth is at best modest in 2014. After 19% earnings growth in the previous year, the forecast for this year is a mere 3%. The Vietnamese stock market reacts remarkably strong on fundamental data, which should be very beneficial for us in the medium term, since our investment style targets undervalued companies with above-average earnings growth. So far, about half of our companies have published their quarterly results. As in previous quarters, we continue to be quite pleased with the company results and with the accuracy of our forecasts. In a relatively weak month like October, some of our shares performed quite nicely. What are the reasons why we continue to be so confident and positive for the next few years? Well firstly there is the future potential of Vietnam to become a trade leader in South East Asia. As can be seen in the chart below, when looking at free trade agreements Vietnam is one of the few countries to have broken away from the peloton in Asia and has the greatest potential to gain from trade and FDI related to labour intensive production. Vietnam has a population of 90 million, which is 3x that of Malaysia, whilst the GDP per capita of Malaysia (USD 10,051) is more than 5x that of Vietnam (USD 1,911). Singapore and Brunei are unlikely to benefit from inbound FDI looking to take advantage of low labour costs and labour intensive production. Each of these countries are economic outliers in Asia that have a combined population of less than 6 million and a GDP per capita of USD 55,182 and USD 38,563 respectively.

Besides the positive economic outlook for Vietnam, the fundamental facts of our holdings are and will continue to be the most important factor. With a current price earnings ratio of 7x – 8x for the year 2014, these shares would have to almost double in order to reach the current market level of almost 14x. The median profit growth of our 70 companies in 2014 should be around 13%, which is significantly above the overall market expectation. With the latest quarterly results, the deviations from our previous earnings estimates for 2014 are at a negligible average of 0.1%. We recently attended a major investment conference in Vietnam where we felt that the initial investor euphoria from spring had faded, which we regard as healthier for the stock market in the long-term. In order to invest successfully, one must be able to learn from his own mistakes and not to get caught up in the hysteria of other market participants - neither euphoria nor panic. Over the past 25 years, often I wasn’t able to capture large profits when I followed other investors or when I sold my positions due to fear of corrections on major stock markets. It sounds of course very irrational, but should the expected correction never happen, investors find it very difficult to buy back their initial position. The Vietnam story is still very exciting and is certainly based now on much better fundamentals than one or two years ago - and our stocks are still trading at very attractive valuations. From a statistical point of view, we are now commencing a period where the Vietnamese stock market should perform very well and as previously mentioned, Vietnam has a very low correlation to the larger developed markets. Ultimately, the old stock market wisdom applies: “It's not about which stocks you buy, but when you buy them.” We think the timing of our fund launch back at the end of December 2013 was very good in comparison to most other funds. Although a performance of around 30% in the first year may sound very good, we launched our fund with the idea of returning several hundred percent over the next few years, and we will do everything possible to reach this goal with the help of our fundamental-quantitative investment style.

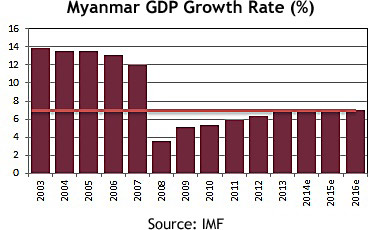

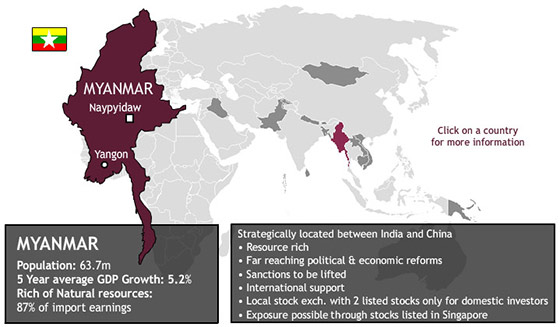

In October the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (3.8%) - a manufacturer of electrical and telecom equipment, FLC Group JSC (3.1%) – a real estate development company, Dong Nai Port JSC (2.2%) – a port operator, KLF Joint Venture Global (2.2%) – a real estate company and Thuan An Wood Processing JSC (2.2%) – a furniture manufacturer. As of 31st October 2014 the portfolio was invested in 70 shares and held 3.5% in cash. The sectors with the largest allocation of assets were consumer goods (34.8%) and industrials (21.2%). The fund’s weighted average trailing P/E ratio was 7.18x, the weighted average P/B ratio was 1.07x and the average dividend yield was 5.70%. AFC Country Snapshot: MyanmarFollowing recent democratization measures, including the release of hundreds of political prisoners, cease-fire agreements with ethnic rebels, and the incorporation of long-time human rights champion Aung San Suu Kyi into the political process, it is apparent that Myanmar is determined to become fully integrated into the international community. After being isolated for the better part of the last three decades, Myanmar is emerging as a potentially high growth target market for private equity investment due to its abundance of natural resources, including oil and gas, attractive tourist destinations, and young, well-educated labor force eager to work at regionally-competitive wages. These attributes, coupled with its strategic location bordering China, India, Thailand and Laos, provide Myanmar with the potential to emerge as one of the most dynamic economies of the twenty-first century.

Stock Market: The Myanmar Securities Exchange was established in 1996 as a joint venture between Daiwa Institute of Research Ltd. (the core information-generating arm of Daiwa Securities group) and Myanma Economic Bank. The exchange lists just two companies -- Forest Products Joint Venture Corporation Ltd. and Myanmar Citizen Bank Ltd. -- and is considered the world’s smallest, if not most primitive stock exchange. In May 2012, the Myanmar Central Bank (MCB) signed a Memorandum of Understanding (MOU) with the Tokyo Stock Exchange Group Inc. (TSE) and Daiwa Institute of Research Ltd. to coordinate efforts toward establishing a securities exchange and supporting the cultivation of capital markets in Myanmar. The upcoming Yangon Stock Exchange has been announced to be launched in October 2015 and Myanmar is expected to allow five companies to be listed. Three local public companies, Asia Green Development Bank (AGD), First Myanmar Investment Co Ltd (FMI) and Myanmar Agribusiness Public Corporation (MAPCO), have already been approved for listing and another two are yet to be chosen.

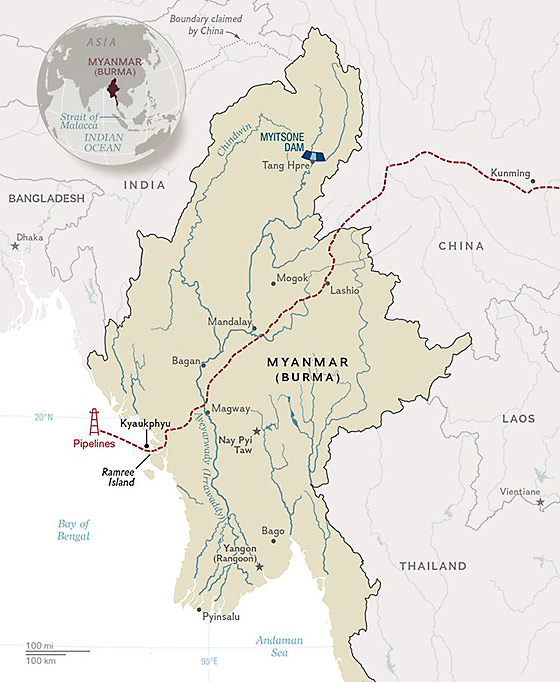

Country snapshots for all of AFC's markets can be found on our website at www.asiafrontiercapital.com AFC Country Report: MyanmarSince being thrust into the international media spotlight in 2011-12 due to sudden political and economic reforms, Myanmar has generated significant buzz among investors and corporations eager to pursue opportunities in the largely untapped former “rice bowl of Asia” that has a population of over 53 million. But despite the flurry of news and activity, many challenges lie ahead for the country as it slowly repositions itself to build rapprochement with the international community, attract much-needed foreign direct investment (FDI) and become more democratic. The reform process has not been without bumps in the road, and the opposition politician Aung San Suu Kyi recently stated at a press conference that the reforms in Myanmar have stalled, with the military still in control of most decision-making and numerous clauses in the constitution yet to be amended. In spite of the slow pace of reforms, many of the sanctions that long crippled Myanmar’s economy have since been repealed, and there has been a dramatic surge in FDI in the country. The Association of Southeast Asian Nations (ASEAN), which has historically had a shaky relationship with Myanmar due to the country’s domestic policies and human rights record, has mended ties and this year’s ASEAN Chairmanship is held by Myanmar, with the annual ASEAN summit to be held next week in the capital, Naypyidaw. This year marks Myanmar’s first tenure as chair, despite having been an ASEAN member since 1997. A major issue at this year’s ASEAN Summit will be the South China Sea disputes, which occurred earlier this year and ruffled feathers between the Philippines, Vietnam, and China. Although Myanmar has no coastline in the immediate vicinity, the country has historically enjoyed cozy relations with China. Beijing was its key ally and strategic trading partner for years while many other nations stayed away due to the US-led sanctions imposed on Burma. But as Myanmar has gradually opened to the West and begun on the path to political and economic reform, it has also reconsidered its relationship with China and started to diversify its geopolitical partnerships to avoid overdependence on Chinese investment and to gradually counter Beijing’s growing influence in the region. Of the 36 oil and gas blocks that Myanmar awarded to 47 companies from October 2013 to July of this year, none was given to a Chinese firm. The contracts were instead handed out to US, Norwegian, French, Anglo-Dutch, and Russian oil majors. China has taken notice of Myanmar’s push to develop ties with other nations that are not necessarily close friends of Beijing. Japan has recently invested millions in Myanmar, including in the 2,400 acre Thilawa special economic zone near Yangon. Japan and China are both jockeying for influence in Southeast Asia, and China is not pleased to see Myanmar diversifying its partners. One catalyst for souring relations between Beijing and Naypyidaw came in 2011, when Myanmar’s president, Thein Sein, suspended the controversial USD 3.6 billion Myitsone Dam project, citing environmental concerns. The move infuriated Beijing, as the dam was to be a key power generator for China’s Yunnan province and was financed primarily by the China Power Investment Corporation. Although China remains Myanmar’s largest source of FDI and its biggest trading partner, Chinese investment has dropped sharply since Myanmar’s reestablishment of diplomatic relations with the West. In the fiscal year ended April 2013, China pledged USD 407 million in new investments in Myanmar, a figure roughly 10% of the USD 4.3 billion that China had provided to the country for the previous year. Despite the uncertainty of how relations between the two countries will evolve in the future, Myanmar’s strategic location is very appealing to China, particularly as it hunts for energy and minerals for its own enormous population. Myanmar’s coastline on the Bay of Bengal and the Andaman Sea looks to be Beijing’s ultimate play, as China desperately seeks an alternate shipping corridor in lieu of the Straits of Malacca. Roughly 40% of China’s oil imports pass through the Straits of Malacca, creating a massive energy security threat for Beijing and a potentially vulnerable chokepoint for its oil supply. China has already completed a crude oil pipeline through Myanmar, running from the Bay of Bengal to China’s Yunnan province. The pipeline is slated to come online later this year and is expected to carry 440,000 barrels of Middle Eastern and African crude per day, while also running alongside a natural gas pipeline. But despite China’s plans for a faster and safer trade route, its pipeline and SEZ projects in Myanmar have stirred discontent among many Burmese, who worry that Myanmar is becoming a pawn in Beijing’s scramble for resources and that the extraction won’t benefit the local population

From an investment standpoint, the Myanmar Securities Exchange Centre (MSEC) is currently the country’s sole stock exchange and only lists two stocks. The two listed companies are Forest Products Joint Venture Corp (FPJVC) and Myanmar Citizens Bank (MCB), both of which are jointly owned by the government and private investors but rarely trade. The illiquidity is primarily because current shareholders in the two listed companies do not want to sell, as the stock prices have only gone up in recent years and there are few attractive investment alternatives. Despite the limited current state of the country’s stock market, Myanmar companies have found alternate ways to raise capital. In July, Myanmar Agribusiness Public Corporation (MAPCO) offered shares to the public, raising just over USD 12 million in its second round of fundraising since establishment in 2012. MAPCO’s target sector in Myanmar is agribusiness, accessed through both trading agricultural goods and investing in agricultural projects, with a primary focus on rice processing and production. Additionally, the firm holds a 5% stake in the Thilawa Special Economic Zone, a large industrial complex developed in conjunction with Japanese conglomerates that is slated to be commercially operational next year. As MAPCO is not listed on a stock exchange, its shares are only available to Myanmar nationals and local citizens can buy shares directly from the company’s headquarters in Yangon. MAPCO shareholders must deal with the company directly, as there is not yet a clearing house or securities exchange commission, raising concerns regarding regulation and financial transparency. But despite the uncertainties, the new fundraising round is an important step to help build the foundation for the country’s capital markets, promote the secondary share market, and pave the way for domestic companies and government-linked corporates to expand their shareholder bases and eventually list on the forthcoming Yangon Stock Exchange. Although Myanmar’s lack of an efficiently-functioning stock exchange, recent emergence from decades of sanctions and junta rule, and corruption may spook investors, recent developments have signaled that things are improving and have given investors reason to be cautiously optimistic. In October, two prominent Singapore arbitrators ruled in favour of Myanma Economic Holdings Limited (MEHL), which has strong ties to the Burmese military, in its dispute with its joint-venture partner, Singapore's Fraser & Neave (F&N), over the future of MEHL’s 55% shareholding in Myanmar Brewery Limited. MEHL is on the Special Designated Nationals sanctions list and is linked to the military, but has been transparent and rule-abiding throughout the arbitration process – a tentatively positive sign for foreign investors eyeing Myanmar. In addition to Myanmar’s undeveloped stock market, foreign ownership remains a problem, and the over-the-counter (OTC) trading and share sales that do occur are strictly limited to Myanmar nationals. Under the current Myanmar Companies Act, foreigners are prohibited from investing in local public company shares. It remains to be seen whether this restriction will be also put into place for the Yangon Stock Exchange when it opens next year, but there are discussions with Daiwa Securities Group to allow 30-40% foreign ownership on the Yangon Stock Exchange. The removal of foreign ownership restrictions would certainly help the development of the country’s capital markets and drive increased foreign investment and interest in Myanmar. Despite only two stocks being listed on the MSEC, there are over 100 public companies in Myanmar. Roughly 20 of the OTC traded companies try to match buyers and sellers, with the most liquid company being FMI Co. Ltd., the domestic holding company of Yoma Strategic Holdings, which is listed in Singapore. For the time being, the best way to access investment opportunities in Myanmar is through companies that are listed on stock exchanges in Singapore and Thailand that have significant operations in Myanmar. We see these “back-door listings” as a good way to access high-potential companies doing business in Myanmar until the YSE is successfully established. We currently maintain holdings in Myanmar stocks focused on the oil, gas and real estate sectors. AFC Travel Report: MyanmarIn line with our process of being on the ground in the countries we invest in, AFC's Contributing Writer, John Enos, travelled to Myanmar to cover the country's development from the ground. But as President Obama prepares to visit Naypyidaw next week for the East Asia Summit and the US-ASEAN Summit, much of the feverish optimism that was abundant when he first visited in 2012 has since waned. Political reforms have been slower than expected, as Aung San Suu Kyi recently pointed out, and ongoing sectarian violence in Rakhine State has spurred many human rights activists to criticize the Myanmar government’s reaction to the crisis. Some American corporations have set up shop and begun investing in Myanmar, but as a recent Bloomberg article pointed out, US companies have committed less than USD 250 million to investments in the country of 53 million people, while in contrast, US companies have invested over ten times as much in Luxembourg, a country of roughly 500,000 people. Regardless of one’s stance on the success of reforms, Myanmar is certainly a fascinating place to visit. When I was there two years ago, ATMs had yet to be fully rolled out, so I arrived in Yangon with a thick envelope of crisp US dollars. Needless to say, I was quite nervous to be carrying such a large amount of money in cash as I hopped into the first unmarked taxi I could find at Yangon Airport and discovered that the toothless driver spoke zero English. I spent my time in Yangon walking around the downtown area, using the traffic circle at Sule Pagoda as my guidepoint. I found Rangoon’s historical buildings in a beautiful state of decay, and the city felt like it had been largely preserved, with few of the hastily-erected apartments or office buildings that you might find in Phnom Penh or Bangkok. If I forgot about the smartphone in my pocket or the occasional flashy Range Rover driving by, the streets of Yangon felt like I was time-traveling back to the 1950’s or so. Downtown Yangon’s decaying colonial buildings and old cars almost made it seem like the Havana of the East.

The scenes on the street in Old Yangon were quite a spectacle – instead of the usual hawkers offering tuk-tuks, fake Gucci bags, or cheap Chinese watches, the sidewalk vendors here were selling traditional Burmese herbs and spices, as well as doing fortune telling and Tarot card reading on the curbside. Sadly, with no Burmese language skills I could employ, I didn’t join the long queue of customers eager to have their palms read by an old Burmese man who did look very wise indeed.

Another curious sight I encountered while strolling Yangon was the presence of women sitting at a table on the sidewalk with several landline phones and people lining up to use them. A home-made phone booth! I hadn’t seen anything like this in any country I had visited before… even in Somalia the nomadic goat herders had their own mobile phones! I asked my Burmese friend who I was staying with why cell phones were such a rarity in Myanmar, and she provided a simple explanation. The cost of SIM cards in Myanmar was several times what the average person earned in one year. Indeed, in 2009, the cost of a SIM card from the monopolistic state-owned carrier was USD 2,000! Mobile phone penetration is still extremely low and SIM cards were prized by those who could afford them. It should come as no surprise that international telecommunications firms were engaged in a fierce competition to secure the international operating licenses for the country. In the end, the government granted the licenses to Norway’s Telenor and Qatar’s Ooredoo, and the price of SIM cards has now fallen to USD 1.50. Talk about the benefits of a liberalized and globally-integrated economy!

One of the other things that distinguishes Yangon from Phnom Penh or Bangkok is the lack of motorcycles. I have come to accept motorcycles as ubiquitous in Southeast Asian cities, and as a loud but useful mechanism for transporting a Vietnamese family of 5, or two hogs that need to be shuttled to a Cambodian slaughterhouse. But motos are banned in Yangon. Motorcycles may seem reckless or dangerous, but they are also more compact and efficient than large automobiles, and I found much of Yangon choked by gridlock as I explored on foot. A friend mentioned to me that the Myanmar government had recently liberalized the country’s vehicle import regulations, and I found plenty of flashy new Japanese and European cars crowding the city streets everywhere I went. I was quite surprised at how many foreign tourists I encountered while there. It appeared that Myanmar had become the “flavor of the month” not only in international news media, but also among the group package tour industry! I shared buses and beers with Koreans, Germans, and Americans, many of whom had flown all the way to Yangon from their home countries solely to explore Myanmar for two or three weeks. The downside to this spike in tourism was that I found Myanmar’s tourism infrastructure stretched beyond capacity. Most of the hotels and guesthouses I arrived at were fully booked for months, and the ones that were available were charging USD 30 / night for a spartan, window-less single room that would have cost USD 4-8 in Cambodia or Thailand. Despite the plethora of sights and amazing tourist attractions, Myanmar still has a long way to go if it wants to rival the tourism industries of its Mekong neighbors.

|

|||||||||||||||

|

I hope you enjoyed reading our monthly newsletter and remain with kind regards, Thomas Hugger |

||||||||||||||||

Disclaimer:This document does not constitute an offer to sell, or a solicitation of an offer to invest in AFC Asia Frontier Fund, AFC Asia Frontier Fund (non-US), AFC Vietnam Fund or any other funds sponsored by Asia Frontier Capital Ltd. or its affiliates. We will not make such offer or solicitation prior to the delivery of a definitive offering memorandum and other materials relating to the matters herein. Before making an investment decision with respect to our Funds, we advise potential investors to read carefully the respective offering memorandum, the limited partnership agreement or operating agreement, and the related subscription documents, and to consult with their tax, legal, and financial advisors. We have compiled this information from sources we believe to be reliable, but we cannot guarantee its correctness. We present our opinions without warranty. Past performance is no guarantee of future results. © Asia Frontier Capital Ltd. All rights reserved. The representative of the Fund in Switzerland is Hugo Fund Services SA, 6 Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of performance and jurisdiction for Shares in the Fund distributed in Switzerland are at the registered office of the Representative. By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions. |

||||||||||||||||

GO TOP |

||||||||||||||||

Source:

Source:

Source: National Geographic

Source: National Geographic Picturesque buildings in Old Yangon

Picturesque buildings in Old Yangon

A street vendor offering landline phone calls. Myanmar’s mobile phone penetration rate was,

A street vendor offering landline phone calls. Myanmar’s mobile phone penetration rate was,