Asia Frontier Capital (AFC) - November 2014 Newsletter |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In this IssueAFC Asia AFC Vietnam Fund

|

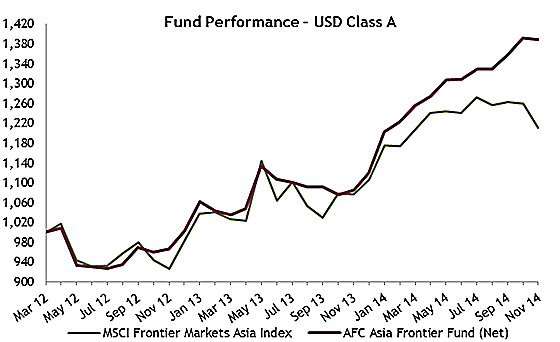

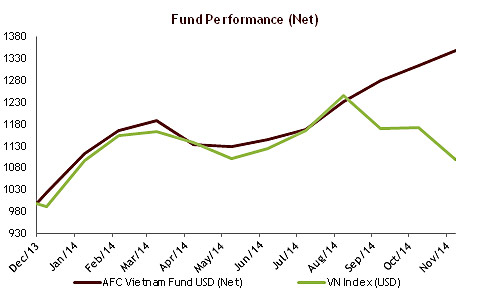

"Two roads diverged in a wood, and I — I took the one In November 2014, the AFC Asia Frontier Fund returned -0.1% and the AFC Vietnam Fund returned +2.5%, bringing the YTD total for our funds to +24.0% and +31.7% respectively. The MSCI Frontier Markets Asia Index (-3.9%), MSCI Frontier Markets Index (-4.7%) and MSCI Emerging Markets Index (-1.1%) had a less than stellar month as they all lost ground and underperformed the AFC Asia Frontier Fund while the MSCI World Index gained 1.8% during the month. The AFC Vietnam Fund has also continued its strong performance since inception as it approaches its one year track record with another outperformance of both the Ho Chi Minh - VN Index (-5.7%) and Hanoi VH Index (-0.7%) in November. The AFC Asia Frontier Fund has now outperformed the MSCI Frontier Markets Asia Index by +14.6% year to date in 2014 net of all fees. One of the key reasons for this breakaway from the closest comparable index to our fund is our strategy of not being benchmark-constrained and investing in companies which are not part of the relative benchmark. Our research has thus enabled the fund to find companies in which we see predictable income streams and/or valuation discounts backed by management teams that are able to deliver in the environment they operate in. Further, since we are positive on the demographics of the countries we invest in, a significant part of the fund’s portfolio is invested in consumer and healthcare companies - 54% of the portfolio as of November 2014. Year to date, the AFC Vietnam Fund has outperformed the VN Index (Ho Chi Minh) by +20.8% and the VH Index (Hanoi) by +4.4% net of all fees. Similarly to the AFC Asia Frontier Fund, the AFC Vietnam Fund takes advantage of the asymmetric information that exists in public equity markets in Vietnam. Outside of the large cap names bought by the major domestic players and foreign institutional investors, Vietnamese equities are vastly under-researched within the small and midcap space. Our fund’s stock selection process is based on a fundamental-quant-model to capture those stocks which are irrationally valued or overlooked to take advantage of this situation. Whilst there are many reasons investors buy and sell equities, every stock market transaction is a zero sum game where one participant buys and one participant sells simultaneously – so net-net one investor always wins and one investor always loses when the price rises or falls. With less access to timely market information and company analysis, this is one of the reasons why the average retail investor typically underperforms professional investors. AFC’s market knowledge gives us an edge and when this is combined with the fact that the AFC Vietnam Fund’s CIO, CEO and COO have more than 75 years’ professional experience investing directly in Asian markets, we continue to expect to perform well in 2015. With regard to the growth of our funds, this month set a new record for monthly inflows into the AFC Asia Frontier Fund, with more than USD 2.3 million being received in November. The AFC Vietnam Fund also saw good inflows in November, and over the past 12 months, Asia Frontier Capital has increased its AUM by more than USD 20 million. With consistent performance, we are looking forward to surpassing this in the coming year. With this in mind, we would like to thank all of our investors who came on board this month, as well as our existing investors who increased their allocation. As this will be the last newsletter published in 2014, we would like to wish all of our readers a pleasant festive season and best wishes for the New Year! AFC NewsAFC Hires Iraq Investment Specialist Asia Frontier Capital is very pleased to announce the latest addition to our team with the hiring of Mr. Ahmed Tabaqchali. Ahmed is a Middle East and North Africa investment specialist and will be playing a key role in overseeing AFC’s investments in Iraq.

AFC in the Media Upcoming AFC TravelIf you will be in any of the locations listed below and have an interest in meeting with our team, please contact our Marketing Director Stephen Friel at

AFC Asia Frontier Fund - Manager Comment

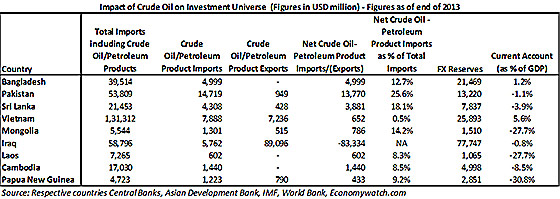

AFC Asia Frontier Fund (AAFF) USD A-shares performed –0.1% in November 2014, outperforming the MSCI Frontier Markets Asia Index (-3.9%) and MSCI Frontier Index (-4.7%) but underperforming the MSCI World Index (+1.8%). November ended flat for the month due to both global and country-specific developments. As our readers are likely aware, crude oil prices have been correcting for the past few months. Brent crude prices are down around 36% since June and were down 18% in November. As expected, lower crude oil prices hurt oil exporting countries and benefit oil importing countries. With respect to our present investment universe, lower oil prices are very positive for our key markets such as Bangladesh, Pakistan, Sri Lanka, and Mongolia. Crude oil and oil-related products make up between 14-26% of total annual imports for these countries. Lower oil prices are also positive for these countries’ current account balances and foreign reserves and help relax some pressure on these metrics, especially for Pakistan and Mongolia. Having said that, given the strengthening of the US dollar, there is a risk that certain currencies could depreciate, but we have not seen any major depreciation in our universe of currencies over the past month. The only country within our universe which is a net oil/energy exporter is Iraq, but at present it does not make up a large part of our portfolio. Crude oil is also a major export for Vietnam, and this could impact its foreign revenues, but it also imports oil-related products as the country still does not have adequate refining capacity and thus the ultimate result of the impact of lower oil prices will likely be netted out. From a portfolio perspective, lower oil prices would benefit the economies of Bangladesh, Pakistan, Sri Lanka, and Mongolia, which cumulatively account for over 50% of the portfolio.

The reason why the fund was able to do better during the month on a relative basis is because energy-related stocks corrected heavily across our markets. For example, energy stocks have a weight of 21% in Pakistan’s KSE-100 index, while PetroVietnam Gas has a weight of 16.6% in the Ho Chi Minh VN Index. With the fund having much less exposure to energy-related stocks at present and also historically (2.3% of November 2014), the correction which impacted many oil & gas counters did not impact AFC’s fund performance. The fund is not under-weight energy stocks because we predicted the oil price collapse, but because we have a preference to invest in consumer or consumption-related stocks. A large portion of the countries in our investment universe have favorable demographics, which will ultimately benefit consumption in the long run. Having said that, some of the energy stocks that we would have liked to invest in had run up in terms of valuations, so the current correction makes some companies look attractive in terms of conducting further research. Most of our larger consumer-related holdings did relatively better than their respective markets whilst some corrected. In addition to this, our Pakistani cement and textile holdings rallied during the month, helping the fund end the month on a flat note. With respect to country-specific developments, our Sri Lankan holdings were doing well in the first two weeks of the month until one of the ruling party’s ministers defected to the opposition party as the current President has called for early elections in January 2015. The current President, Mahinda Rajapaksa, has spent two terms in power and has overseen the redevelopment efforts of the country since the end of the war in 2009. There has been talk that certain ministers were not happy with the way the President was using his power, which has led to defections by some senior ministers to the opposition party. There is an expectation that given the defections, the elections would see a good contest, but it must be noted that Mahinda Rajapaksa has a strong following amongst the masses in the rural areas of the country, except in the North and parts of the East. We shall see how the elections play out, but at present we continue to like our top holdings in Sri Lanka and any correction in prices is viewed by us as a buying opportunity. The best performing indices within the AAFF universe in November were Iraq (+8.0%), followed by Pakistan (+2.7%) and Laos (+1.7%). The poorest performing markets were Bangladesh (-7.8%) and Vietnam (-5.7%). The top-performing portfolio stocks were a Mongolian junior gold mining company (+66.7%), followed by a Pakistani textile spinning mill (+37.3), a Myanmar-focused electronics company (+22.2%), and a Bangladeshi denim producer (+19.7%). In November we added to existing positions in Laos, Mongolia, Pakistan, and Vietnam. As of 30th November 2014, the portfolio was invested in 116 shares, 1 closed-end fund (with 25.7% discount to NAV), 1 GDR (with 61.2% discount) and held 7.6% in cash. The two biggest stock positions are a pharmaceutical company in Bangladesh (5.2%) and a pharmaceutical company in Pakistan (4.9%). The countries with the largest asset allocation include Vietnam (21.7%), Pakistan (20.3%), and Bangladesh (13.8%). The sectors with the largest allocation of assets are consumer goods (40.7%) and healthcare (13.3%). The weighted average trailing portfolio P/E ratio (only companies with profit) was 14.32x, the weighted average P/B ratio was 1.76x and the dividend yield was 4.36%. AFC Vietnam Fund - Manager Comment

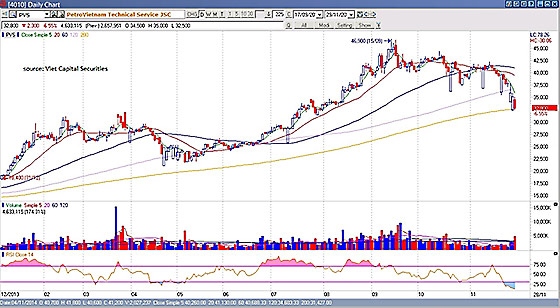

To read this month’s fund update in German please click here. In November 2014 the AFC Vietnam Fund returned +2.5%, bringing the total YTD return to +31.7%. The Ho Chi Minh index fell by -5.7% this month and in USD terms the drop was over -6% due to the slightly weaker Vietnamese Dong. The Hanoi index, which is followed by far fewer foreign investors, lost -0.7% in local currency terms. The initial attempts to start a year-end rally at the beginning of this month were quickly nullified in the second half of November. Some smart stock market professionals started to realize that the 40% fall in oil prices since June might have a negative impact on the profitability of the heavily index weighted oil and gas companies.

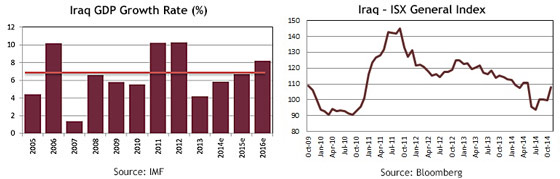

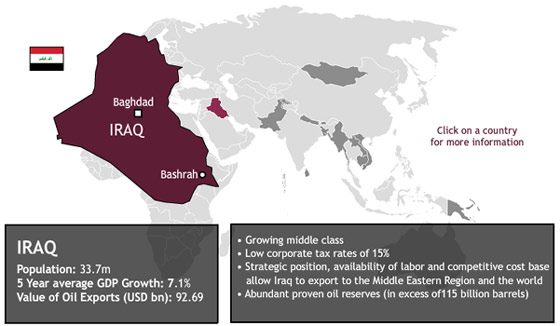

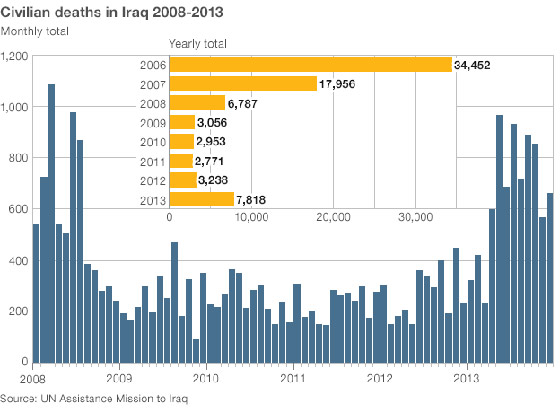

Overall the market sentiment was pretty poor, mainly due to a new government draft to regulate foreign ownership of properties, which many people regarded as still too restricted. This was also due to a newly introduced margin loan regulation which limits brokers to provide cash advances for the purchase of shares. All our 70 companies have now reported their 3rd quarter results and we expect an average profit growth for 2014 of around +14%, while the overall market will grow by only +3-5%. We revised our internal median estimates for 2014 profits and sales +1.8% up - a testament to the quality and methodology of our estimates. With a few exceptions, the majority of our stocks were barely affected by the outflow of foreign or margin loan investors. The stock price of some of our holdings increased nicely after they announced their earnings and all that lead to another increase in our NAV. The AFC Vietnam Fund is now up +34.8% since inception on December 23, 2013. On a political level, the negotiations for the TPP (Trans-Pacific Partnership) and the European Union free trade agreements are at an advanced stage and the signing by all parties of the TPP in the coming weeks or months could provide a nice catalyst for a flourishing stock market next year. Inflation expectations for 2014 are now, due to the sharp fall in oil prices, at only 3% and the economic growth in 2015 should continue to accelerate above 6%. Due to several reasons over the course of the past few weeks, the currency came under pressure. Putting this into context, the whole "devaluation" against USD for 2014 is just over 1%, which is more or less the daily movement of EUR or JPY on a weak day. It is also worth noting that the Vietnamese Dong was much stronger than most other currencies this year. Due to the now only moderate increase of the overall Vietnamese market of approximately +15% year-to-date 2014, we see significantly greater potential for 2015 than we did a few months ago, given the unchanged positive economic environment. In November, the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (5.1%) - a manufacturer of electrical and telecom equipment, FLC Group JSC (2.8%) – a real estate development company, SPM Corp (2.3%) – a pharmaceutical company, Dong Nai Port JSC (2.1%) – a port operator and Foreign Trade Forwarding, and Transport (2.1%) – a logistics company. As of 30th November 2014, the portfolio was invested in 70 shares and held 3.1% in cash. The sectors with the largest allocation of assets were consumer goods (34.6%) and industrials (22.4%). The fund’s weighted average trailing P/E ratio was 7.36x, the weighted average P/B ratio was 1.10x and the average dividend yield was 5.84%. AFC Country Snapshot: IraqDespite being plagued by armed conflict for most of the last decade, Iraq’s economy is rebounding and showing promising signs for surging growth in the future. Iraq is an enormously wealthy country, devastated by over 30 years of terrible conflicts and crippling sanctions, and almost torn apart by civil strife. Energy lies at the heart of the Iraq investment story, and the country is home to the world’s 5th largest proven oil reserves (143 billion barrels), as well as the 13th-largest proven gas reserves. However, much of Iraq is underexplored, especially in comparison to major oil producers in the region, and industry estimates suggest it could have an additional 100-150 billion barrels of reserves. Iraq’s oil industry is extremely competitive, with the lowest extraction costs in the world at around USD 5 a barrel. The development of these resources can fuel its social and economic development in the next few years. This is in addition to the wholesale reconstruction of the country whose infrastructure was destroyed or at best deteriorated following the traumatic events of the last 30 years. The petroleum-rich nation has attracted investment not only from US companies, but also from firms in South Korea and China, which invested USD 12 billion and USD 3 billion respectively in Iraq in 2012. Since 2003, Iraq’s GDP growth has been driven by the rehabilitation of the oil sector, and the country hit a 30 year high for both production and exports in February 2014. The size of Iraq’s economy has increased from around USD 50 billion in 2005 to USD 138 billion in 2010 and is expected to be USD 232 billion by the end of 2014. Growth in the future will also be supported by Iraq’s domestic population, which currently stands at 35.9 million. The favorable demographics will enhance the development of the economy given that the population is growing at 3% per annum and more than half the population is under the age of 25. Iraq, however, faces many challenges before it can begin to achieve its potential. In the last 10 years, since the invasion in 2003, there have been issues stemming from the disastrous policies of the prior government which deepened civil strife and created divisions within the country that led to the disintegration of the Iraqi army and loss of territory to ISIL. Even with ongoing challenges, Iraq’s improving security situation and foreign investment in its energy sector will contribute to developments in infrastructure, telecommunications, and transportation. Additional sectors garnering the attention of investors are consumer goods and real estate, as the country faces a major housing shortage

Stock Market: The Iraq Stock Exchange (ISX) is located in Baghdad and launched operations in 2004 (it opened to foreign investors in 2007). The ISX is a self-regulatory organization and is governed by the Iraqi Securities Commission (ISC) which was modeled on the US’s SEC. The exchange operates an electronic trading platform provided by NASDAQ-OMX and the ISX currently lists 82 companies in a variety of industries including financial services, construction, agriculture, hotels and food processing. Total market capitalization was USD 8.0 billion as of November 2014 and the market cap to GDP ratio is under 4%. This is significantly lower than countries in the MENA region which have the same ratio at levels between 25%-90% which highlights the scope of potential developments for Iraq’s capital markets over the coming years.

Country snapshots for all of AFC's markets can be found on our website at www.asiafrontiercapital.com AFC Country Report: IraqUnless you have been living under a rock in 2014, you are well aware of the negative international media attention that Iraq has garnered due to the rise of the Islamic State of Iraq and the Levant (ISIL). Public outrage and stern condemnations have been issued to ISIL by the United States, specifically in response to several grisly beheading videos that shook the Western perception of a military campaign that was “out of sight, out of mind” to its core. Sadly for Iraq, ISIL is just the latest reason why the country has found itself perpetually in the news, and although the civil war in Syria has dominated headlines for several years, much of the violence, sectarian strife, and political instability in Iraq has continued unchecked. To have a positive outlook on Iraq, you either need to know the underlying story very well or you need to dig deep for signs of progress. The underlying story is that despite the violence and instability, Iraq is quietly undergoing an economic revival thanks to its resurgent oil sector and growing interest in the country from foreign corporations. Some of this progress slowed with the sudden rise of ISIL in 2014, but the fundamental opportunities remain the same: Iraq is estimated to have the world’s 5th largest oil reserves, roughly 140 billion barrels, and production reached 3.6 million barrels per day (bpd) in February, a 30-year high. Even with the threat of ISIL looming, Iraq produced 3.4 million barrels per day (bpd) in November, which was an increase of 100,000 bpd over October and makes the country the second largest oil producer in OPEC after Saudi Arabia. Much of the increase in production can be attributed to increased Western investment (Iraq has recently signed drilling and exploration contracts with numerous international energy companies including Exxon-Mobil, BP, Shell, and Total), as well as superior US drilling equipment that was previously unavailable for decades due to the crippling sanctions that were levied against the country in the era of Saddam Hussein. Although global oil prices have experienced a sharp decline in recent months, Iraq’s reserves are estimated based on seismic data from decades ago, and geologists estimate that unexplored regions of the country may contain even greater deposits. Iraq’s aggressive ramp-up in output can be attributed to the country’s Integrated National Energy Strategy (INES), developed in 2013 in cooperation with The World Bank and Booz & Company. The plan laid out an ambitious goal to significantly ramp up production, which now is expected to reach 5-6 million bpd by 2020 and to meaningfully grow beyond this by 2030. To hit its output targets, the INES projects that Iraq will need a whopping USD 620 billion (nearly 3x Iraq’s 2013 GDP of USD 223 billion) invested in its oil and gas-related industries through 2030. Despite the magnitude of investment required, the INES also sees a huge potential payoff, forecasting that Iraq’s oil and gas industries could generate roughly USD 6 trillion for the country before 2030, although the forecasts are based on an estimated price of USD 100 per barrel. Despite the huge oil reserves, Iraq and Kurdistan have squabbled for years over how to settle the distribution of oil revenues from Kurdistan, as the Kurds feel neglected by the central government in Baghdad in not receiving their full 17% allocation of Iraq’s budget – Kurdistan has traditionally received only 12% of the government budget. In recent years, Erbil, Kurdistan’s capital, has triggered outrage in Baghdad by spurning the central government and unilaterally signing agreements with international oil companies. Kurdistan also increasingly became cozy with Turkey, a regional heavyweight that relies on oil imports. Kurdistan has moved forward with plans for two pipelines to export crude via Turkey, bypassing Baghdad. Construction on the first pipeline, which will connect to an existing pipeline with a capacity of 1.5 - 1.6 million bpd, has now been completed and there are plans to build a second oil pipeline to Turkey within the next two years with a capacity of 1 million bpd. But one major sign of progress for Iraq in settling its ongoing dispute with Kurdistan occurred on December 2nd, when the Iraqi government announced that it had reached a long-term agreement with the autonomous Kurdish region to share both oil revenues and military resources. The deal is a potential game-changer and will help fast track increased oil production, foster renewed stability, and boost economic growth in the country. The agreement stipulates that Kurdistan will receive its full allocated 17% of the Iraqi national budget, which is mostly funded by revenues from oil sales, in exchange for Kurdistan agreeing to sell 550,000 bpd through the Iraqi government's marketing arm, the State Owned Marketing Organization (SOMO). Previously, Kurdistan had been circumventing Baghdad and negotiating its own independent, more lucrative contracts with international oil companies (IOCs). This infuriated the Iraqi central government, which declared such contracts illegal and, with the United States’ support, attempted to pursue any international buyers who might buy directly from the Kurdistan Regional Government (KRG) through legal action and threatened to punish them by excluding them from drilling Iraq’s southern oil fields. The result of the ongoing profit-sharing dispute is that many IOCs in Kurdistan have not been paid, which has hindered additional exploration and investment in Kurdistan. The dispute had also sidelined the passage of a hydrocarbon law in Iraq, which further held back investment in the country’s oil industry. The implications of the deal are significant, because the agreement signals that the Iraqi federal government accepts the legality of the KRG's previously negotiated oil deals, as well as the KRG’s right to manage production in Kirkuk, which has long been a source of dispute. From Iraq’s standpoint, the agreement signifies that Kurdistan agrees to work with the marketing monopoly of SOMO. Ironing out the differences and reaching an agreement removes the biggest uncertainty for IOCs, and the move will likely usher in a new wave of oil and oil-related investment and capital expenditure spending. The agreement could also contribute to the development of similar deals by other oil-producing regions such as Basra, the source of most of the country’s southern fields. The other reason why the accord is significant is because the deal mandates that the KRG will receive USD 1 billion in military aid to pay, train, and equip its fighting force, the peshmerga, to fight ISIL. The funding will be provided directly by the central government in Baghdad from the state defense budget, and will continue be funded from the state budget in the future. This economic boost to Kurdish forces will strengthen Iraq’s arsenal against ISIL and will considerably help efforts to maintain Iraq’s stability and reduce the vulnerability of Kurdistan to ISIL’s advances and seizure of territory. Two emerging factors contributed to the necessity for both Iraq and Kurdistan to get the deal done. One factor is the growing threat of advances by ISIL, which seeks to establish an Islamic caliphate and is waging war against both sides. The second motivating factor has been the slump in the global oil market sparked in October when Saudi Arabia unilaterally cut oil prices, sending the commodity’s price into a downward spiral. As both Iraq and Kurdistan are heavily reliant on oil exports as a source of cash, the lower global oil prices have forced both sides to tighten their belts and incentivized them to increase production to boost revenues. Although the deal between the Iraqi government and the Kurdistan Regional Government (KRG) should be applauded by international observers, oil-producing countries and OPEC member states were likely worried about the timing of the deal. With global oil prices currently depressed and an estimated oversupply of 1.8 million barrels per day, the recent deal will add roughly 300,000 barrels per day to world supplies. After the announcement of the agreement, Benchmark Brent crude fell 2.8% to USD 70.54 per barrel. Regardless of where global oil prices are headed, the recent agreement between Iraq and Kurdistan should be seen as a positive harbinger, and we remain bullish on the long-term potential of Iraq due to the country’s incredible oil wealth, the resilience of its population, and the strengthened opposition to the security threat of ISIL. AFC Travel Report: IraqIn line with our process of being on the ground in the countries we invest in, AFC's CIO of Iraq investments, Ahmed Tabaqchali, recounts some of his experiences from Iraq and the country’s development over the past several decades.

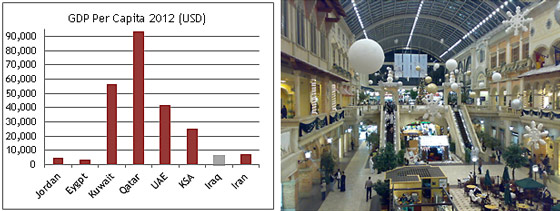

Although horrific and true, the news reports tend to discuss Iraq in aggregate and do not reflect conditions in the country’s different regions, nor do they truly reflect the other side of life in Iraq as experienced by Iraqis on a daily basis. Iraqi Kurdistan, known as the Kurdish Region of Iraq (KRI), is an oasis of calm and fast becoming a bustling business hub. The KRI has been semi-autonomous since the 1990’s and had its independence enshrined in the Iraq constitution after 2003 and is governed by the Kurdish Regional Government (KRG). Erbil, the capital of Iraqi Kurdistan, is experiencing an oil boom and is billing itself as a “new Dubai”. Any traveler who saw Dubai in the 90’s would likely agree with this comparison: Erbil’s new USD 500+ million airport is run by the same group that manages Dubai’s airport and the city’s existing 5-star hotels are filled to capacity with Western businessmen, with new hotels being planned by Hilton, Sheraton, and Marriot. The capital boasts shiny new malls, BMW and Mercedes car dealerships, and numerous luxury apartments being financed and operated by regional players in the Gulf Cooperation Council (GCC) that have experience developing similar projects in Dubai, Abu Dhabi, and Doha. This newfound wealth can be seen across Kurdistan’s other major cities as well such as Sulaimaniyah and Dahouk. Other parts of Iraq have also experienced development, but it has not been as uniform as in Kurdistan. Baghdad, Iraq’s capital, has been the scene of most of the country’s bombings and violence, and is a mosaic of both destruction and prosperity. Shopping malls with interiors that mirror those in Dubai and sell everything under the sun are springing up everywhere, but the malls are often surrounded by bombed-out buildings and located on roads filled with concrete blast walls and roadblocks. This contrast is everywhere in Baghdad – scenes of destruction bump up against popular new cafes and restaurants, many of which are full to capacity, as sociable Iraqis carry on with their lives as normal. Nowhere is the rise in prosperity more evident than in Iraq’s hotels, which are being renovated and are attracting international partners. This growth is reflected in the country’s stock market, with the poster child of the group, Babylon Hotel, returning 76% in 2013 and rallying a further 100% by early June of this year before declining 29% by the end of November following ISIL’s takeover of Mosul. Nevertheless, the stock is still up 50% YTD. The Iraq Stock Exchange (ISX)-listed hotel group has a market capitalization of USD 405 million as of the end of November, and accounts for 5.1% of the ISX’s market cap. The group’s earnings are negligible, and thus earnings multiples are eye-watering. But the performance of Babylon Hotel may be the first sign of the huge potential recovery slated to take place in Iraq. Only time will tell… Another area that has seen growth is real estate. Baghdad’s property prices have been rising significantly over the last couple of years, as rising prosperity and limited supply in the capital have led to an uptick in prices. One such play is a listed real estate investment company, Mamuora Real Estate Company, which after a modest 8.5% rise in 2013, rallied 36% through May before declining 30% following the events of the fall of Mosul. However, this drop did not last, with the stock recovering 32% from its lows to end at a gain of +25% YTD.

In terms of the national psyche, Iraqis are a hardy and resilient bunch who are determined to enjoy what life has to offer despite having suffered through over 30 years of terrible wars, crippling sanctions, and almost seeing their country torn apart by civil strife. Iraqis today are opening up to the world and eager to enjoy the consumer goods, technology, and services that have rapidly spread around the globe. This trend has been supported by sharply rising personal income, with GDP per capita roughly in line with the Middle East’s non-oil producing countries such as Jordan and Egypt, but significantly lagging oil producers like Saudi Arabia and Qatar.

Much of Iraq’s infrastructure was destroyed during the 30 years of conflict and the infrastructure that wasn’t destroyed has suffered from lack of upkeep and maintenance. The fact that Iraq’s oil industry, roads, power lines, and bridges have functioned at all is a testament to the ingenuity of Iraqis. One such casualty was Iraq’s fixed telephone line network, with currently fixed line penetration around 6%. However, Iraqis quickly adopted mobile phones, which were forbidden prior to 2003, with enthusiasm, and currently mobile penetration stands at over 80%. Iraq is served by 3 GSM operators with country-wide licenses. Thus far, the operators have only been able to offer 2G, with the result that the huge demand for online access has been satisfied by several expensive fixed line networks. The shortage of internet bandwidth continues, with an estimated 10% of Iraqis having internet access. The attractiveness of this opportunity for operators was demonstrated in November, when Iraq’s three mobile operators, Zain Iraq (a unit of Kuwait's Zain), Asiacell (a subsidiary of Qatar’s Ooredoo), and Korek (an affiliate of France’s Orange Telecom) each made the first installment of USD 73 million out of a total of USD 307 million each to boost radio spectrum in order to offer 3G services in the country. The significance of this can only be appreciated by noting that the three operators each paid USD 1.25 billion in 2007 for a 15-year technology neutral GSM license (including 3G). As such, the USD 307 million sum is only for the extra spectrum enabling 3G for the remaining eight years of this license. The operators expect to offer 3G in early 2015, which should ultimately lead to huge growth in smart phone usage and internet services. Iraq is still primarily a cash economy, and over 80% of Iraqis do not have bank accounts. The Iraqi banking system is dominated by state banks, which account for 90% of the banking system assets and 86% of deposits. Such assets and deposits mostly reflect those of state owned enterprises, which dominate the non-oil economy and are barred from using private sector banks. Most small and medium-sized enterprises (SMEs) and small businesses still rely on self-financing from family and friends. Moreover, overall private sector usage of the banking system relies mostly on state banks for deposits and loans. Private sector deposits are at 9% of GDP vs about 70% in the region, with 40% of these or 3.6% of GDP with the private banks. Loans, ex-trade financing such as LC’s or LG’s, are at 6.5% of GDP (2013 figures) with only 39% of those, or 2.5% of GDP with private banks, which compares to around 55% for regional comparables. The implications of low banking penetration compounded by the tiny share of private sector banking are that there are potentially massive growth opportunities for private sector banking as banking usage and credit expansion takes hold in Iraq. This movement from cash-based economies to banked economies has unfolded across the world, in post-conflict countries or countries with no previous banking culture. I will end this travel note, for now, with an image of Scheherazade and King Shahryar that has a deep significance to modern Iraqis.

The story of Scheherazade, a legendary Persian queen and the storyteller of One Thousand and One Nights is representative of a history of survival through decades of horrors that the Iraqi spirit has endured. The statue of her was created in 1972 by Mohmmed Hikamt, who portrayed her as a strong woman commanding attention and representing the new women of Iraq that were taking up an active role in society. Her story provides a link between Iraq and the West, and the cultural mixing of these two factions has been expressed in the music of Rimsky Koriskove. She stands as a symbol of what Baghdad was and, one day, will become again - open, exciting, full of hope, and secularly building towards the future. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

I hope you enjoyed again reading this month’s AFC newsletter. On a personal note, I would like to thank all of our investors for the continued support this year as we progress to build Asia Frontier Capital’s footprint in Asia in 2015. Best wishes to all our readers from the whole AFC Team to you and your family for the coming Festive Season as well as the New Year! Thomas Hugger |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Disclaimer:This document does not constitute an offer to sell, or a solicitation of an offer to invest in AFC Asia Frontier Fund, AFC Asia Frontier Fund (non-US), AFC Vietnam Fund or any other funds sponsored by Asia Frontier Capital Ltd. or its affiliates. We will not make such offer or solicitation prior to the delivery of a definitive offering memorandum and other materials relating to the matters herein. Before making an investment decision with respect to our Funds, we advise potential investors to read carefully the respective offering memorandum, the limited partnership agreement or operating agreement, and the related subscription documents, and to consult with their tax, legal, and financial advisors. We have compiled this information from sources we believe to be reliable, but we cannot guarantee its correctness. We present our opinions without warranty. Past performance is no guarantee of future results. © Asia Frontier Capital Ltd. All rights reserved. The representative of the Fund in Switzerland is Hugo Fund Services SA, 6 Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of performance and jurisdiction for Shares in the Fund distributed in Switzerland are at the registered office of the Representative. By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GO TOP |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||