Asia Frontier Capital (AFC) - October 2016 Newsletter |

||||||||||||||||||||||||

In this IssueAFC Asia AFC Iraq AFC Vietnam Fund

|

"Elections have consequences"

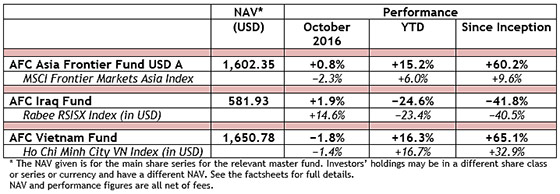

AFC Funds Performance Summary

Now that the race for the Presidency of the United States of America is concluded, many analysts are pondering the possible consequences of the outcome of the election for their investments and how to best position investment portfolios for return maximization or risk management. As the US is the most important country in the world right now, the policies of the US government have a far reaching effect. For the frontier markets that we invest in, there are different impacts, depending on the individual country. Uncertainty is an enemy of market sentiment, as some investors opt to stay in cash or go to cash and only get back into a risk-on mode after stability has returned. With the election of Donald Trump, uncertainty is likely to continue for quite some time, until it becomes more clear to what extent Trump will follow through on the plans announced during the race for the presidency as some of these plans are nationalist, controversial, and perhaps impossible to implement, and might not get the approval of Congress, despite the Congress having a Republican majority. During the campaign for the presidency, Donald Trump had talked about the renegotiation or cancellation of trade pacts to benefit the US labour force. On the North American Free Trade Agreement (NAFTA), which has already been in place for over a decade, Trump said: "We will either renegotiate it, or we will break it." He called the Trans-Pacific Partnership (TPP) Agreement a “horrible deal”. He claimed that Hillary Clinton had changed her stance on the TPP as a result of his opinion about it, but actually during the primaries, Bernie Sanders’ ideas may have pushed Clinton to reconsider her support of the TPP. The TPP free trade pact is an agreement between 11 countries in the Pacific Rim and the US. It is significant as it could raise the GDP for each participating country by 1.1%. In terms of the relevance for our investment universe, Vietnam is a signatory to the TPP and it is interesting to note that China is not part of the TPP. But it is a well-known secret that China would benefit from it as well, through the back door, as China would be able to invest in businesses in trade pact member countries. Besides that, China has already agreed separate bilateral trade agreements with 8 of the 12 countries that signed on to the TPP. Hillary Clinton, having participated in the negotiations of the TPP, was of course a proponent of the TPP in 2012. In November of that year she said it “sets the gold standard in trade agreements to open, free, transparent, fair trade, the kind of environment that has the rule of law and a level playing field”. In the race for the presidency however, she had changed her opinion and/or public stance as there was a lot of opposition from the public and from her opponents in the race for the presidency, most elaborately voiced out by Bernie Sanders, as it would further support the move of manufacturing jobs from the US to other countries particularly to Asia. It is possible that she changed her stance on the issue to appeal more to the working-class Americans that may be affected by such export of labour, while in competition with Sanders for the democratic nomination. Trump is also against the imbalance in the current US-China trade relationship. There are numerous issues, but the single most important one proved to be manufacturing jobs in the US. In the Trump Presidency, action to curb the US-China trade deficit could possibly provide opportunities to other Asian countries as effectively Chinese exports to the US would become more expensive. Trading hubs like Hong Kong and Singapore would be impacted alongside China. However, the protectionist policies that can be expected from Trump could also impact trade from frontier countries to the US. We think that the Donald Trump presidency means that there could be changes in international trade with the US and these changes may also have an impact on frontier markets in Asia. However, these countries also have healthy domestic economies and our investments tend to target companies focused on domestic demand rather than export-driven demand. Though there is expected to be some amount of uncertainty over the next few months, we remain confident on the domestic focused companies that we have invested in. While polling agencies and forecasters have missed the boat in the case of the Brexit referendum, and now yet again during the US Presidential elections, we like to think that we have much better forecasting skills than these pollsters, certainly if you look at our AFC Asia Frontier Fund and AFC Vietnam Fund performance statistics. This past month AFC received two additional awards:

Investor Review awarded Asia Frontier Capital as the “Best Fund Management Firm – Hong Kong” in their 2016 Single Manager Awards. Investor Review’s press release talks about the awards selection process and says to “commend those most deserving for their ingenuity and hard work”, which is something we take pride in. The results are there to show that this ingenuity and hard work pays off handsomely. In the face of volatile and difficult periods, the AFC Asia Frontier Fund and the AFC Vietnam Fund have shown superb performance with low volatility and no negative years.

We obtained a second award this month, which was given by Wealth & Finance International for our achievements in investing in frontier markets in Asia. We are happy to receive this recognition as it again highlights our expertise in the area. We have achieved very good returns in the Asian frontier markets with our AFC Asia Frontier Fund and our AFC Vietnam Fund without taking outsized risks, resulting in very smooth performance charts as can be seen further below in the sections about each of these funds. Ahmed Tabaqchali presenting at “Showcase Iran 2016” Ahmed Tabaqchali, the CIO of the AFC Iraq Fund, will be speaking at the “Showcase Iran 2016” conference in London which will be held on Monday 28th – 29th November 2016 at Grand Connaught Rooms. Office Move in Hong KongWe are pleased to announce that we have moved to a new and larger office, in the same building in Hong Kong. Our phone numbers, fax number and email addresses remain unchanged. Only the unit number changed from 1208 to the new unit of 905 on the 9th Floor of Loon Kee Building. The complete address is:

AFC in the Press

Upcoming AFC TravelIf you have an interest in meeting with our team during their travels, please contact Peter de Vries at

AFC Asia Frontier Fund - Manager Comment October 2016

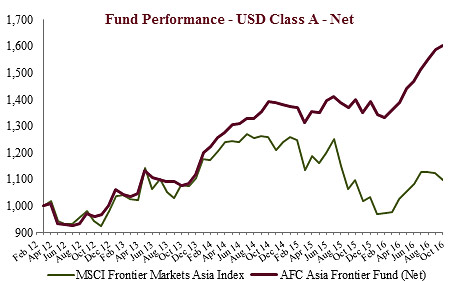

AFC Asia Frontier Fund USD A-shares gained +0.8% in October 2016. The fund outperformed the MSCI Frontier Markets Asia Index (-2.3%), the MSCI Frontier Markets Index (-0.5%) and the MSCI World Index (-2.0%). The USD A shares achieved a NAV of USD 1,602.35, which is a new all-time high (the previous high was in September 2016 with USD 1,589.07). The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 now stands at +60.2% versus the MSCI Frontier Markets Asia Index (+9.6%) and the MSCI Frontier Index (+2.1%) during the same time period. The fund’s annualized performance since inception is +10.8% p.a. while its YTD performance stands at +15.2%. Though the benchmark fell by more than 2%, the fund was able to generate a positive performance this month primarily due to good performance by a few individual stocks. The fund’s top holding, a Bangladeshi pharmaceutical company, was up +31% while two of the beer companies the fund holds in Vietnam rallied due to the news of the listing and divestment of Sabeco (Saigon Alcohol Beer and Beverage Corp.) and Habeco (Hanoi Beer Alcohol and Beverage Corp.). Sabeco and Habeco hold the number one and number three position in Vietnam in terms of market share based on volumes, and the companies the fund holds are subsidiaries of both these companies. The fund has held these companies over the past few years as they were/are extremely cheap with P/E ratios of <10x and with the divestment of Sabeco and Habeco this strategy of holding on to these companies is paying off. Another positive contributor in Vietnam was a company which produces convenience food products which are available in most supermarkets in HCMC. This was also a “cheap” stock which has done well for the fund. The fund also exited one of its larger holdings in Vietnam, a stationery company. This stock has done very well for the fund with a return of 2.4x and we exited this position solely on valuation grounds. Pakistan had a weaker month due the build-up of political tensions between the ruling party and one of the opposition parties. This tension is a repeat of August 2014 when the opposition party staged blockades in the capital and also planned another blockade on 2nd November 2016. However, as of the end of October, there has been a court-ordered compromise for the moment which led to a 3.5% gain for the KSE100 Index on 1st November. Though such political noises are expected to happen in the run-up to the national elections in 2018, the outlook for Pakistan is still positive and it continues to be the fund’s second largest country allocation. Bangladesh had positive news due to the visit of Chinese President Xi Jinping during the month. China has agreed to invest ~USD 14 billion into various infrastructure-related projects including power plants and though this investment is not as big as that committed to the China Pakistan Economic Corridor, it certainly will help to improve Bangladesh’s infrastructure which currently lags behind most of South Asia. The best performing indexes in the AAFF universe in October were Iraq (+14.6%), Laos (-0.1%), and Vietnam (-1.4%). The poorest performing markets were Cambodia (-5.7%) and Mongolia (-5.5%). The top-performing portfolio stocks were a Vietnamese brewery (+56.4%), a Vietnamese food producer (+38.8%), a Bangladeshi pharmaceutical company (+30.7%), and a Mongolian gold exploring company (+30.3%). In October 2016, we added to existing positions in Laos, Mongolia, Pakistan, Papua New Guinea and Vietnam and we reduced our existing holding in a Mongolian and Pakistani company. We newly added a Pakistani insurance company, a Pakistani leasing company, a Pakistani logistics company, a Vietnamese insurance company, and a Vietnamese real estate company. We exited a Vietnamese stationary products company and a Pakistani media company. As of 31st October 2016, the portfolio was invested in 98 companies, 1 fund and held 6.8% in cash. The two biggest stock positions were a pharmaceutical company in Bangladesh (8.2%) and a Pakistani pharmaceutical company (5.3%). The countries with the largest asset allocation include Vietnam (30.8%), Pakistan (23.6%), and Bangladesh (16.4%). The sectors with the largest allocation of assets are consumer goods (36.3%) and healthcare (17.0%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 20.24x, the estimated weighted average P/B ratio was 3.66x and the estimated portfolio dividend yield was 3.26%. For more information about Asia Frontier Capital’s Asia Frontier Fund please click the following links: AFC Iraq Fund - Manager Comment October 2016

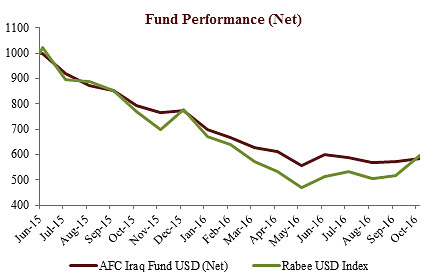

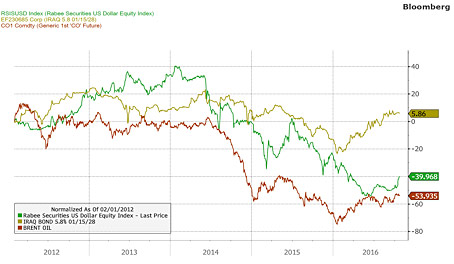

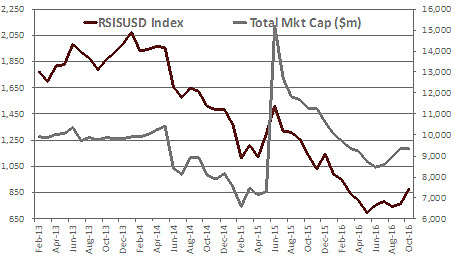

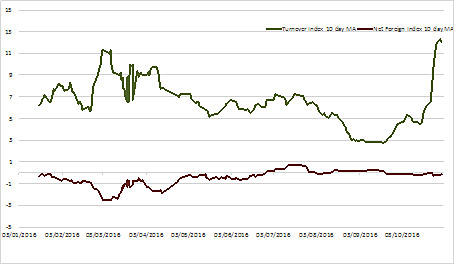

AFC Iraq Fund Class D shares returned +1.9% in October, an underperformance of -12.7% vs. the Rabee RSISX USD Index (RSISUSD) which returned +14.6% in USD terms. The fund has underperformed the RSISUSD by -1.1% YTD and -1.3% since inception. The equity market, after a significant lag throughout 2016, has started to catch up with oil prices and Iraq’s bond which have rallied about +84% and +36% respectively from the January multi-year lows (see chart below). A rally of + 59% in the Bank of Mosul on the back of a +50% increase last month, in combination with rallies in other low-quality, low-priced but high beta stocks contributed to over 50% of the index’s move in October. Rabee Securities’ RSISUSD Index (green), Iraq’s USD 2.7 bn Bond (gold) and Brent Crude (red) As highlighted in last month’s newsletter, an underperformance by the fund was expected during the initial phase of the market’s recovery, marked by sharp bounces in low-quality, low-priced but high beta stocks which can be seen from the index vs. market capitalization chart below which shows a flat market capitalization for the month. However, the October moves, especially in the Bank of Mosul, beat expectations, with the month's substantial under-performance turning the +7.2% out-performance over the market YTD into a deficit of -1.1%. The Fund was unable to overcome the twin headwinds of (1) not owning the low-quality, low-priced but high beta stocks; (2) circumstances forced an underweight position in one of the highest quality companies in the market. Baghdad Soft Drinks (IBSD), which has an index weighting of 25%, resumed trading in October and gapped up about 20%, after a 3-month trading suspension while the regulator was reviewing its proposed merger as mentioned in the past. During this period, strong inflows into the fund resulted in a significant dilution in its position in IBSD as it was suspended from trading and costing about 200-250 bp in performance miss. The Iraqi market (Rabee USD Equity Index) vs. Total market Capitalization Notwithstanding the frustrations of lagging the index, the market is going through a textbook example of a discount mechanism in action: it is anticipating the end of the conflict on meaningfully expanded volume driven entirely by local liquidity (see chart below). Almost every stock that is rallying is extremely leveraged to the economic recovery post-conflict, which at this early stage of the rally is irrespective of the quality of the company or its earnings potential. Specifically, within the banking group (under 30% of market capitalization but over 80% of trading volume), locally owned banks, as opposed to those majority owned by regional banks, are leading by leaps and bounds. Entirely dependent on the local economy, they have seen their businesses collapse over the last two years with rising non-performing loans (NPL’s) and falling deposits. While the quality of these banks, even at the rosiest of economic scenarios is at best suspect, their leverage to economic recovery is in no doubt. This leverage plays out similarly within the hotel group, in which the leading company had a rally of 42% during the month and currently trades at over 60 times earnings. Turnover on the Iraq Stock Exchange (ISX) vs net foreign trading It is logical to conclude that the nature of the rally is positive for the future direction of the equity market and local sentiment. Especially, noting that the index’s -23.4% return YTD, even after the October rally, significantly lags the Bond’s +20% YTD return. With the high-quality names down up to -45% YTD and mostly flat in the last two months, there is scope for market rotation. The fund's holdings are high-quality companies whose earning power/assets/franchises have held up well during the last two years. Furthermore, the growth in their earnings and asset values is expected to outpace the economic recovery post-conflict. Most are either +/- a few percentage points for the month, yet there is every reason to expect that they will resume market leadership as part of the market’s bottoming and eventual long-term recovery process. This confidence is borne out by the unfolding of events along the lines discussed here in the past few months, and thus it is reasonable to expect the resumption of market leadership by high-quality stocks and as such the fund is well positioned for a sustainable participation in this recovery. However, it is unlikely to happen in a single month but expected to unfold over the next few months, irrespective of underperformance for a month or more. The fund’s holdings were chosen with a focus on the long term to capture the post-conflict opportunities, while the weightings of individual stocks in the portfolio were decided on each company’s fundamentals and taking risk into account. As was pointed out in December, Iraq’s nascent market necessitates the creation of either highly concentrated indices as the RSISUSD Index or unusable broad indices as the ISX’s Index. Within the RSISUSD, the stocks & weights are chosen primarily for their liquidity, and as such, driven by the speculations of a retail-driven market. Although the resulting index is a reasonable representation of the most actively traded stocks, it nevertheless is at odds with the aim of a long-term portfolio. The upshot is likely a wide disparity between the index and the fund in any given month, but over the long-term, a delta between the two should emerge and provide a more meaningful measure of performance. As can be seen from the fund's performance chart, this happened when the market bounced after extreme declines which the fund had mostly avoided. While the index's sharp rebound significantly overtook the fund for the months in question, yet it brings it in-line with the fund’s trajectory. Although admittedly the fund is still young, the performance of the holdings since inception and through the market’s brutal decline confirm the choices made in constructing the portfolio. The battle for the Liberation of Mosul is progressing better than expected from both military and humanitarian standpoints. Civilian casualties, mercifully, have been far less than feared with the preparation of Iraq’s international sponsors in providing support and aid for the displaced populations able to meet the challenges. Crucially, neither the fears of fierce destructive battles nor sharply inflamed sectarian tensions materialized, which is promising for the future of the country. Granted, it is early in the campaign, and there is potential for the fears to materialize once the battle comes to the center of Mosul. The promising start is nevertheless encouraging, and could be a sign of ISIS’s disintegration from within, especially if the anticipated fierce street to street battles do not unfold as feared. Another positive development is the proposal underway for national reconciliation under international auspices which, once again is in very early stages, yet is promising for the country’s political stability post-ISIS. As of 30th October 2016, the AFC Iraq Fund was invested in 14 names and held 1.6% in cash. As the fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq, the countries with the largest asset allocation were Iraq (97.0%), Norway (2.5%), and the UK (0.5%). The sectors with the largest allocation of assets were financials (56.9%) and consumer staples (20.4%). The estimated trailing median portfolio P/E ratio was 9.81x, the estimated trailing weighted average P/B ratio was 0.89x, and the estimated portfolio dividend yield was 2.38%. For more information about Asia Frontier Capital’s Iraq Fund, please click the following links: AFC Vietnam Fund - Manager Comment October 2016

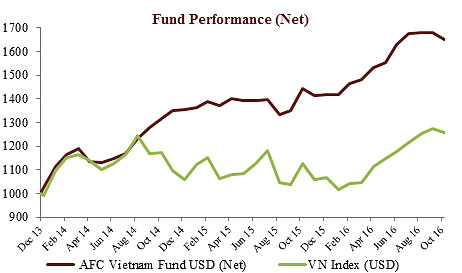

The AFC Vietnam Fund returned -1.8% in October with an NAV of USD 1,650.78, bringing the year to date net return to +16.3% and the net return since inception to +65.1%. This represents an annualized return of +18.8% p.a. By comparison, the October performance of the Ho Chi Minh City VN Index was down -1.6% while the Hanoi VH Index decreased by -3.3% (in USD terms). Since inception, the AFC Vietnam Fund has outperformed the VN and VH Indices by +39.5% and +51.2% respectively (in USD terms). Like many other markets around the globe, Vietnam was in correction mode in October. As observed in the broader market for some time now, blue chips were digesting recent gains with the main index in Ho Chi Minh City losing -1.4% in local currency. Smaller stocks in Hanoi were down even more with the index -3.3% lower for the month. Market developments While stocks were broadly weaker last month, attention turned to third quarter results. We saw many individual stock price movements, also within the portfolio. But more important than short term price action is the fact that companies are delivering their expected profits. While several sectors were impacted by either low oil prices or the drought during the 2015/16 season, we see positive developments in many of the fund’s investments. After about 90% of the portfolio companies reported results so far, they were pretty much in line with our forecasts and our adjustments to full year profits were minimal. Furthermore, as many stocks in the portfolio corrected over the past few months, while the fund barely lost value, the portfolio is now very attractively valued again. The general market is currently valued about 75% higher than the portfolio of about 80 stocks. With the fund’s broad diversification and low volatility, we are now waiting for the next upturn in the broader market which had a hard time for most of the year. The major theme for the fourth quarter is the upcoming privatization and listing of well-known companies which will further bring attention to the Vietnamese stock markets. HABECO The long-awaited listing of Hanoi Beer Alcohol and Beverage (Habeco), the country’s third largest brewery, finally took place on the 28th October with its listing on UPCoM. The initial price was set at VND 39,000 (USD 1.75), giving it a market value of $405 million. The stock ended its first trading day at VND 54,600 with only 100 traded shares, jumping 40% against the reference price.

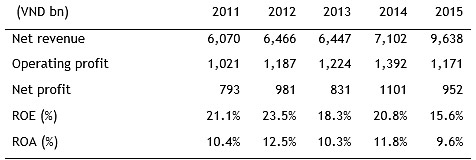

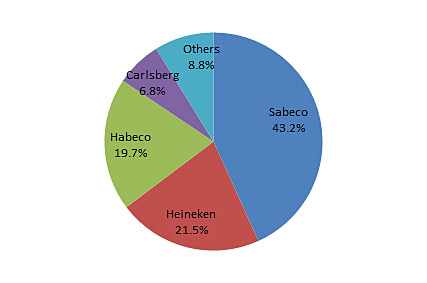

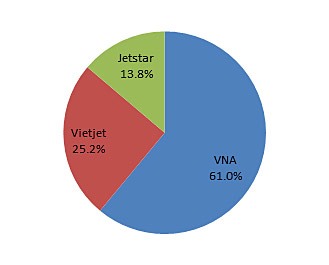

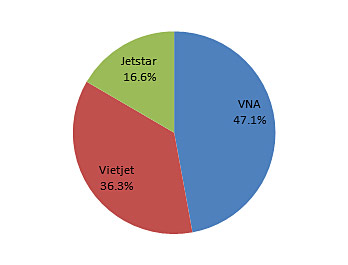

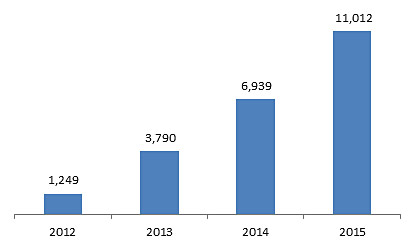

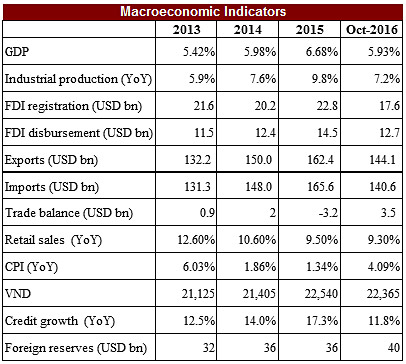

In 2015, the company produced 670,000 million liters to catch 19.7% market share after Sabeco and Heineken. In the last five years, net revenues of Habeco jumped by 58.8%, however its market share was decreasing year after year, losing ground to other competitors such as Heineken and Sabeco. Market share in 2015 The Government currently holds 81.79% and the Danish brewer Carlsberg owns 17.23%, hence the free float is only 2.2 million shares. Until the Government actually divests its entire stake as planned, we expect dismal liquidity and upward pressure on the stock price. But once they offload their stake, shares may go straight to a strategic investor, such as Carlsberg, which intends to double its stake in Habeco as they have preemptive rights to do so. The bottom line is, there is no lack of interest in Vietnam’s beer market, with consumption of 3.8 billion liters in 2015, making it one of the largest in Asia. Vietnamese beer drinkers are expected to consume more than 4 billion liters in 2016, which equates to an average of 27.4 liters of beer per year per person. This is the highest per capita consumption in Southeast Asia and the third largest in Asia after Japan and China. Vietjet Air IPO Vietjet, the fastest growing Vietnamese low-cost airline, has delayed plans for an initial public offering in Singapore or Hong Kong because of legal complications, since the company must first IPO in its home country, according to Vietnamese law. Vietjet was founded in 2011 by Ms. Nguyen Thi Phuong Thao, a property and banking tycoon. The company has been growing at an amazing pace to be the largest airline in Vietnam with revenues growing 9x in the period from 2012-2015. In 2015 the airline carried 9.3 million passengers and is hoping to increase that to 15 million this year as the company adds routes and aircraft to its existing fleet of 45 single-aisle Airbus A320s and A321s. Regarding CAPA – Center for Aviation, Vietjet’s market share jumped year after year to reach 36.3% in 2015 and 40.0% in January 2016. According to the estimation of CAPA, Vietjet has probably overtaken Vietnam Airlines as the largest aviation company in Vietnam as of June 2016. This year Vietjet has placed orders for 100 Boeing 737s and 20 Airbus A321s to replace its leased fleet and expand capacity by roughly 10 aircraft per year. Market share in 2013 Market share in 2015 Vietjet has built a name for itself in the aviation industry in Vietnam. In 2015, the company reported net revenues of VND 11,012 billion (USD 495 million) and a net profit of nearly VND 1,000 billion (USD 45 million), which is much higher than Vietnam Airlines. Net revenue of Vietjet (VND bn) In November 2014, Vietnam Airlines was privatized after selling 62.2 million shares, equivalent to 5.55% to investors at an average price of VND 22,300 per share. The company was valued at USD 1.12 billion at that time. If Vietjet plans to undertake the IPO in 2016, the company may reach an estimated value of USD 1 billion. The aviation industry in Vietnam looks quite promising over the coming years, with a population of 92 million and rising income. Vietnam has the fastest growing middle class in Asia Pacific, according to Boston Consulting Group, and hence its customer base is expected to grow rapidly, given that more and more people are becoming able to afford to travel by air. Economy Inflation saw a strong surge in October, rising to 4.09% YoY (+0.83%) mainly due to price hikes in healthcare and transportation. The government wants to keep inflation in 2016 below 5% and we believe this is achievable. In October, total FDI disbursement stood at USD 12.7 billion, +7.6% YoY. This is an important figure since it reflects foreign investors’ confidence, showing a continuation of investments into industrial processing and manufacturing. Export value in October recovered slightly compared to September and advanced by 0.5% to USD 15.5 billion. Consequently, total exports in the first ten months of the year hiked 7.2% YoY to USD 144.1 billion. The General Statistic Office of Vietnam commented the following regarding the Samsung’s Galaxy Note 7 issue: “The battery problems required Samsung to recall its products and stop exporting this model out of Vietnam. Hence exports of mobile phones and accessories are expected to fall, however it will not be significant because of following reasons: 1) Galaxy Note 7 is partly produced for the domestic market; 2) The model’s contribution in Samsung Vietnam’s export is not significant; 3) Samsung Vietnam is pushing other models such as Galaxy S7 to cover the loss from Galaxy Note 7”. Imports in October increased by 7.9% against September to USD 15.7 billion. Total import value in the first ten months hit USD 140.6 billion (+2.1% YoY), while the trade surplus reached USD 3.5 billion. The Ministry of Agriculture and Development announced that the country’s total export value of agro-forestry and fishery products in the first ten months recorded an increase of 6.3% YoY, valuing USD 26.4 billion. USD 12.5 billion are from main farming products (+7.8% YoY), USD 5.7 billion from seafood products (+5.9%) and USD 5.8 billion from forestry products. Various main farming products saw impressive increases in the nation’s export value, notably mentioned coffee accelerated 40.2% YoY with a value of USD 2.76 billion and pepper advanced 35.7% YoY recorded USD 1.29 billion in value. (In October alone, the total export value of agro-forestry and fishery products was estimated at USD 2.75 billion.) A draft on tax deduction submitted to National Assembly is promised to boost entrepreneurship. Under this term, corporate income tax for Small- and Medium-Sized enterprises would be narrowed from the current 20% to 17% between 2017 and 2020. By the end of 2015, public debt reached VND 2,600 trillion (USD 116bn), equivalent to 62.2% of the country’s GDP, which is still lower than the limit of 65% of GDP. More important however is the ratio of short-term debt to foreign reserves. If we look at key Asian countries, the majority – including Vietnam - are within a modest and manageable range. This situation will need to be monitored and managed carefully and is certainly a balancing act between an expanding economy, enabling corporates to generate profits and its supportive government measures such as e.g. infrastructure spending, tax incentives, etc. We are confident that Vietnam will find the right balance and are therefore very optimistic about its future economic outlook.

Other developments We saw a tiny depreciation of the Vietnamese Dong in October. It is worth to mention that this small 0.10% loss against the USD is the first movement since early this year. Almost every year there is an increasing demand for USD towards the year end. This year that is also the case, especially since the USD is appreciating and the Chinese Yuan has been depreciating 1.5% last month and 4.1% year to date. The depreciation of the Yuan was one of the main reasons behind the weakness of worldwide stock markets early this year, but nobody seems to care much this time around, which is quite astonishing...

At the end of October, the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (2.9%) – a manufacturer of electrical and telecom equipment, Bao Viet Securities JSC (2.0%) – a securities brokerage company, Agriculture Bank Insurance JSC (1.9%) - an insurance company, Pharmedic Pharmaceutical Medicinal JSC (1.9%) – a pharmaceutical company, Vietnam Sun Corp JSC (1.8%) – a travel services company. The portfolio was invested in 84 names and held 3.2% in cash. The sectors with the largest allocation of assets were consumer goods (34.4%) and industrials (23.5%). The fund’s estimated weighted average trailing P/E ratio was 10.87x, the estimated weighted average P/B ratio was 1.56x and the estimated portfolio dividend yield was 6.38%. For more information about Asia Frontier Capital’s Vietnam Fund please click the following links: AFC Travel Report – MongoliaIn line with our process of being on the ground in the countries we invest in, Thomas Hugger, CEO of Asia Frontier Capital and Fund Manager for the AFC Asia Frontier Fund, travelled to Mongolia last month to attend an investor conference. The best time to travel to Mongolia is during the summer months when the temperature is still nicely above freezing. I departed Hong Kong on a sunny September morning where the temperature was 33 degrees. 4 ½ hours later I landed in Ulaanbaatar where the temperature was a cool 12 degrees. It was clear that winter was not far off. With so few international flights connecting Mongolia to the outside world (there are about 9 major connections to places like Beijing, Hong Kong, Istanbul, Berlin, Seoul, etc. and some smaller cities in Siberia) the country remains isolated from most international travellers. Arriving at the Chinggis Khan International Airport in Ulaanbaatar “UB” is like stepping back into Soviet times. Unfortunately, my flight was inconveniently timed with an incoming flight from Seoul which created havoc in the small immigration hall. A decaying Soviet-era relic, the airport is soon to be replaced by a much larger airport funded by the Japanese which will alleviate congestion both inside the airport and prevent outgoing flights from being delayed (in some cases more than 14 hours) by the city’s harsh air pollution during winter months. Having visited UB two years earlier (our investment analyst, Scott Osheroff, spent about three months in Mongolia last summer) I was keen to know how UB had changed during that time, financially and economically speaking. The facts were sobering; UB today faces extremely difficult times with a currency which is down almost 80% from its peak and a construction bubble which burst to wreak havoc in the property market. I still remember two years ago how full of cranes the skyline was (at the time I counted over 27 cranes standing in one place) and buildings sprouting around me like mushrooms. Today the visual is much more sombre. Driving on the main road between the airport and downtown, it was nice to see hardly any cranes and much of the construction completed, but as we arrived in the city centre, several office buildings were either completed but entirely vacant, or half constructed. Uncompleted office building from 2012 in the city centre of Ulaanbaatar The first company I visited during my stay was a duty-free shop operator with a small shop at the UB railway station (where the Trans-Siberia Express linking Moscow with Beijing passes through) and at the Russian border. The company’s stock had a dividend yield of over 20% over the past 4 years (when our fund started buying it) and additionally its price appreciated nicely since initial purchase. Then, a few months ago one of the largest local conglomerates acquired the company and is now seeking to buy out minority shareholders. This is one of the many examples of opportunity for investors amidst the “gloom and doom” of an economy suffering from a fallout in the resource sector. I came across several other such bright spots during my trip as well. The next company I visited was the largest integrated cashmere producer in Mongolia and the 4th largest in the world, and a factory visit thereafter. It just so happened that the day I was visiting was the company’s 60th anniversary and there was a large lunchtime celebration in the front courtyard. Amid the celebration, I was still able to grasp the quality of their operations by comparing them to a competitor I visited during my trip two years prior. This company employs 1,300 people in Ulaanbaatar, has a domestic market share of 66% and represents 44% of Mongolian exports (70% of its products are exported as “white label”). Mongolia’s goats annually produce 8,500 tons of high-quality wool due to the cold climate used in the production of cashmere. This company buys 500 tons directly from herders, while most of the balance is purchased by Chinese traders. Hence, it is not a surprise that Erdos Cashmere, based in Inner Mongolia / China, is about eight times larger than this leading Mongolian cashmere producer, indicating Mongolia’s domestic cashmere manufacturing industry has significant upside potential. During my visit I also took the opportunity to meet the company’s CFO and after signing various documents collected the 2015 dividend for the Fund. Asia Frontier Capital’s CEO Thomas Hugger receiving AFC Asia Frontier Fund’s 2015 dividend Later that day I met with the President and CEO of another top performing Mongolian company and a rising star in AFC Asia Frontier Fund’s portfolio—a gold and copper explorer listed in Canada. Having seen its shares appreciate 212% year-to-date thanks to fantastic drill results (of up to 49 grams per ton of gold), meetings with such companies tend to carry a more “relaxed” tone when everybody is happy and making money. Unfortunately, the next day reality set back in when I met with two concrete producers and a construction materials company. These companies have not only been struggling because of a weak property market, but are also exposed to a collapsing construction sector since a government stimulus plan to subsidize mortgages from the high teens and low 20’s to 8% for apartment buyers has hit road bumps. En route to these companies, I passed by one of the four coal-fired power plants in the city casting a somewhat ominous view of Mongolia’s future. Below is a photo of Power Station #3 which generates 198 MW power through operation of nine coal-fired boilers which is certainly not the most attractive visual: Ulaanbaatar Power Plant #3 As can be seen in the background, the sun was shining; however, the emissions clouded the sky. These power plants make the “coldest capital city in the world” also the “most polluted capital city in the world” (worse than Beijing). With the lowest population density in the world at 1.92 people per square kilometre, this is an unfortunate situation for Mongolia. Back to my three visits for the day, it was interesting to learn how these companies survive in a cash-strapped and sluggish economic environment. The two concrete producers, for example (like many of the other 140 concrete companies in UB) have resorted to using a “barter system” to get paid. This means that concrete is sold against payment of cars, trucks and unfinished apartments in lieu of cash, while other concrete producers are selling concrete against cash below production costs. Regarding the construction materials company, while their “bread and butter” had previously been selling infrastructure related materials to the road and public engineering industries, they have since shifted to focus on the manufacturing and sale of railway sleepers. With multiple new railway lines planned from the country’s largest coal mine (Tavan Tolgoi) to the Chinese border and an eastward and westward railway expansion, it will be a coup for any company who wins a tender to supply these projects. Worrisome however is that as most of these projects are being financed by Chinese SOE’s, it may result in the majority of these tenders being awarded to Chinese companies, as has been the case in other countries where China is implementing its “One Belt One Road” policy. The next day I had the opportunity to meet the CEO of the Mongolian Stock Exchange (MSE) and to discuss with him the outlook of the MSE which has probably one of the lowest daily average turnovers of any stock exchange in the world (in August 2016 it was less than USD 6,300 per day)! Trading floor of the Mongolian Stock Exchange “MSE” during trading hours During my five-day trip, I also met with two property companies, a brewery, an IT company, a tourist company, a coal mine and a milk company who all had their own daily issues and methods for surviving this difficult economic environment. However, I would like to end this travel report – which was more about doom and gloom – with two positive notes. One positive development is the restart of the gigantic Oyu Tolgoi “OT” mine in the south of the country which is 66% owned by Turqouise Hill Resources (which is majority owned by Rio Tinto) and the remainder by the Mongolia Government. At full capacity, Oyu Tolgoi will be the third largest copper/gold mine in the world. For the second development phase of the mine an additional USD 6 billion needs to be invested for this underground construction (Phase I is “open pit”) and this should help bolster the country’s depleted foreign exchange reserves, create new jobs and more importantly send a message to other international mining companies that the country is “open for business” after all the issues since 2012 between the government and international mining companies. The second positive development is that international resource prices have bottomed out and are starting to rise, especially coal and gold, which are extremely important for the well-being of the Mongolian economy. Below is the monthly price chart of coal (delivery Richards Bay, South Africa) Consequently we have increased our exposure to Mongolian coal mining companies in the AFC Asia Frontier Fund through increasing an existing position and adding a new Mongolian coal mining company.

At last, there are some positives among the “gloom” in Mongolia and there is a good chance that the economy has bottomed which should result in an upward revaluation in the currency and lead to higher share prices. |

|||||||||||||||||||||||

|

I hope you have enjoyed reading this newsletter. If you would like any further information, please get in touch with me or my colleagues. With kind regards, Thomas Hugger |

||||||||||||||||||||||||

|

Asia Frontier Capital Limited |

||||||||||||||||||||||||

Disclaimer:This Newsletter is not intended as an offer or solicitation with respect to the purchase or sale of any security. No such offer or solicitation will be made prior to the delivery of the Offering Documents. Before making an investment decision, potential investors should review the Offering Documents and inform themselves as to the legal requirements and tax consequences within the countries of their citizenship, residence, domicile and place of business with respect to the acquisition, holding or disposal of shares, and any foreign exchange restrictions that may be relevant thereto. This newsletter is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law and regulation, and is intended solely for the use of the person to whom it is intended. The information and opinions contained in this Newsletter have been compiled from or arrived at in good faith from sources deemed reliable. Opinions expressed are current as of the date appearing in this Newsletter only. Neither Asia Frontier Capital Ltd (AFCL), nor any of its subsidiaries or affiliates will make any representation or warranty to the accuracy or completeness of the information contained herein. Certain information contained herein constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of Funds managed by AFCL or its subsidiaries and affiliates may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is not necessarily indicative of future results. © Asia Frontier Capital Ltd. All rights reserved. The representative of the funds in Switzerland is Hugo Fund Services SA, 6 Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of performance and jurisdiction for Shares in the Fund distributed in Switzerland are at the registered office of the Representative. AFC Asia Frontier Fund is registered for sale to qualified /professional investors in Japan, Singapore, Switzerland, the United Kingdom and the United States. AFC Iraq Fund in Singapore, Switzerland, the United Kingdom and the United States. AFC Vietnam Fund in Japan, Singapore, Switzerland and the United Kingdom. By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions. |

||||||||||||||||||||||||

GO TOP |

||||||||||||||||||||||||