Asia Frontier Capital (AFC) - November 2016 Newsletter |

||||||||||||||||||||||||

In this IssueAFC Asia AFC Iraq AFC Vietnam Fund

|

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas."

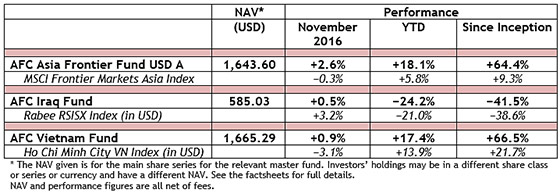

AFC Funds Performance Summary

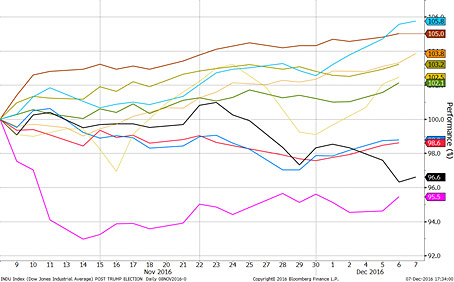

AFC had another great month with all funds recording positive returns in November 2016 with the AFC Asia Frontier Fund and the AFC Vietnam Fund gaining, while their respective benchmarks lost. They outperformed their respective benchmarks by +2.9% and +4.0% in November and have gained +18.1% and +17.4% so far this year. With emerging markets in general having sold off after the US presidential election and frontier markets having retreated on average, be it to a much lesser extent, our funds performed well as a result of smart country allocation and outstanding stock selection. Our strategy of investing with a longer term view in frontier economies with an emphasis on the consumer sector and with appropriate diversification is paying off. We are confident this strategy will continue to flourish in the future as our frontier markets universe continues to offer excellent investment opportunities with their continuing high levels of GDP growth, favourable demographics, low labour costs and an emerging middle class with rising disposable incomes. November’s financial markets worldwide have all but been defined by the surprising outcome of the U.S. presidential election. Often the removal of uncertainty as a result of an election supports an increase in the stock market, but in this case, a drop in the equity markets was feared once Trump was elected. However, the drop quickly transitioned into a rally that lasted for the remainder of the month and saw the Dow increase by +4.3% and the S&P500 by +2.8% since the election. The initial surprise and fear about the policies the President-elect might choose to implement was overtaken by a positive sentiment for equities. Certain stocks did better than others and bonds generally dropped in price due to the infrastructure spending Trump is planning which will require significant borrowing, and thus put upward pressure on interest rates. Internationally, the impact on the markets after the election has been mixed. While all of our funds have booked gains in November, emerging markets and frontier markets have generally declined. Emerging markets felt the brunt of Trump’s win as investors withdrew from markets that may be impacted by his protectionist approach to international trade. This stance, which will result in the cancellation of the TPP free trade agreement and the renegotiation of NAFTA, will not be encouraging for the export sectors in emerging and frontier markets. The potential future constriction of free trade saw the MSCI Emerging Markets Index drop by -7.2% after election day and partially recovered to end the month down -4.4%. As expected, frontier markets were much more resilient. These markets didn’t drop as violently after the election, but did lose some ground as the MSCI Frontier Markets Index dropped -2.4% by month-end and the MSCI Frontier Markets Asia Index dropped only -2.1% by month-end. The chart below shows the above-mentioned indexes since election on 8th November through to month-end. The indexes of the individual markets we invest in were mixed, with Pakistan and Bangladesh up +3.2 and +2.8% and Vietnam down -1.5%, while Iraq was pretty volatile, ending the month with a loss of -0.9%. Indexes since Trump Election

On the currency front, the chart below shows how the Euro, Yen, GBP and the main currencies in our portfolio have fared since the election. It is noteworthy that while the Chinese Renminbi declined by -1.5%, the Euro declined by some -4.1% and the Yen toppled -8.7%, the currencies in our top 3 countries were relatively stable. The Pakistani Rupee and the Bangladeshi Taka remained basically flat, while the Vietnamese Dong lost -1.5% in value by the end of November. Currencies since Trump Election The frontier markets we invest in have survived the volatility, after the surprising election results, quite well. It can be explained on the one hand by the fact that frontier domestic economies have a low correlation with the fortunes of developed markets and on the other hand that only a limited number of shares are in the hands of international investors and funds, which buy and sell shares depending on global euphoria and fear. These factors combined with diversification over the different Asian frontier markets and currencies, and coupled with superb stock picking has provided our funds with another successful month of performance. We are looking forward to a great close of the year for our funds and are confident in being able to continue to generate consistent outperformance at low volatility in 2017 and beyond. AFC in the Press

Upcoming AFC TravelIf you have an interest in meeting with our team during their travels, please contact Peter de Vries at

AFC Asia Frontier Fund - Manager Comment November 2016

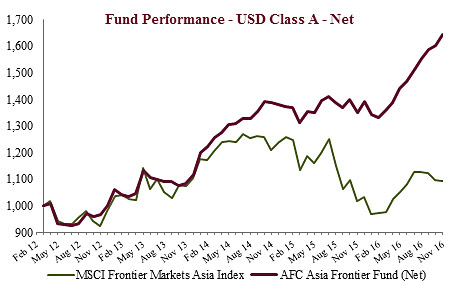

AFC Asia Frontier Fund USD A-shares gained +2.6% in November 2016. The fund outperformed the MSCI Frontier Markets Asia Index (-0.3%), the MSCI Frontier Markets Index (-1.9%) and the MSCI World Index (+1.3%). The USD A shares achieved a NAV of USD 1,643.60 which is a new all-time high (the previous high was in October 2016 with USD 1,602.35). The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 now stands at +64.4% versus the MSCI Frontier Markets Asia Index which is up +9.3% and MSCI Frontier Index (+0.2%) during the same time period. The fund’s annualized performance since inception is +11.2% p.a. while its YTD performance stands at +18.1%. The broad diversification of the fund’s portfolio has resulted in lower risk with an annualised volatility of 9.19%, a Sharpe ratio of 1.16 and a correlation of the fund versus the MSCI World Index USD of 0.34, all based on monthly observations since inception. This was another month of outperformance for the fund primarily due to stock selection and country/sector allocation, as has been the case since inception. Performance was led by Pakistan and Bangladesh, with a good all round performance in Pakistan. Major gains were made by a Pakistani technology focused company which the fund has entered into over the past month. In Bangladesh, gains were led by a consumer food company which focuses on frozen foods but is expanding into new areas including ice-cream which has significant potential in an underpenetrated market like Bangladesh. In the most recent quarter, this company declared good numbers which points to successful expansion into the ice-cream business. This resulted in a +78% move in the stock price during the month and helped with performance. Vietnam was a drag on performance as the market corrected a bit, most probably due to the uncertainty caused by the election of Trump. Given the anti-trade comments he has made in the run up to the election, it was not surprising to see the Vietnamese market come under some pressure given both exports contribute a large portion of GDP and that the U.S. is Vietnam’s biggest export market. Over the past several weeks Trump has also publicly stated that he will repeal the TPP (Trans Pacific Partnership) agreement, an agreement which Vietnam would have benefited from. However, it does not come as a surprise that the TPP will not be going ahead as this has been expected for some time given the anti-trade talk in the run up to the U.S. elections. This, however, does not change either our view or outlook for Vietnam as, TPP or no TPP, the country still stands to benefit from the cyclical upturn that it is going through. The foreign investment that has come in over the past few years was not necessarily all linked to TPP, but instead was due to the fact that Vietnam provides a stable environment for lower cost manufacturing jobs in the technology and textile industries. Minimum wage in Vietnam is still 40-60% lower than in the industrialized regions of China, such as Guangzhou, and this has led to a large number of multinationals transitioning operations to the country. The latest budget was announced in Sri Lanka. Given the government’s goal of reducing its fiscal deficit it was not surprising to see taxes and duties raised on sectors including telecom services and alcoholic beverages, as well as the removal of concessionary tax rates for the hotel and construction industries. Besides these moves, the government has also raised excise duties on tobacco and alcoholic products, as well as having increased the Value Added Tax rate from 11% to 15%. These moves could potentially impact consumer spending in the upcoming quarters but the market has already been underperforming so far this year in anticipation of increasing taxes and also a tighter monetary policy. The best performing indexes in the AAFF universe in November were Pakistan (+6.8%), Bangladesh (+4.6%), and Iraq (+3.2%). The poorest performing markets were Sri Lanka (-2.6%) and Vietnam (-1.6%). The top-performing portfolio stocks were a Mongolian oil exploring company (+98.3%), a Bangladeshi food producer (+78.2%), a Mongolian copper exploring company (+46.9%), and a Mongolian coal mine (+45.6%). In November, we added to existing positions in Bangladesh, Laos, Mongolia Pakistan and newly added a Bangladeshi paint company and positions in five new Mongolian companies. As of 30th November 2016, the portfolio was invested in 105 companies, 1 fund and held 5.9% in cash. The two biggest stock positions were a pharmaceutical company in Bangladesh (8.6%) and a Pakistani pharmaceutical company (5.4%). The countries with the largest asset allocation include Vietnam (28.8%), Pakistan (24.9%) and Bangladesh (17.9%). The sectors with the largest allocation of assets are consumer goods (32.6%) and healthcare (20.3%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 20.95x, the estimated weighted average P/B ratio was 3.54x and the estimated portfolio dividend yield was 3.08%. For more information about Asia Frontier Capital’s Asia Frontier Fund please click the following links: If you would like to receive the updated factsheets and presentations automatically attached to an email, please drop a line to AFC Iraq Fund - Manager Comment November 2016

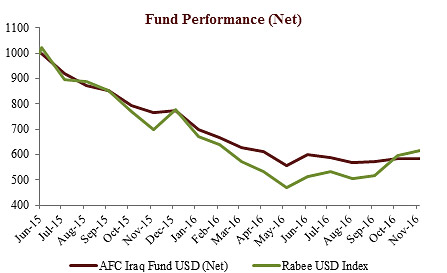

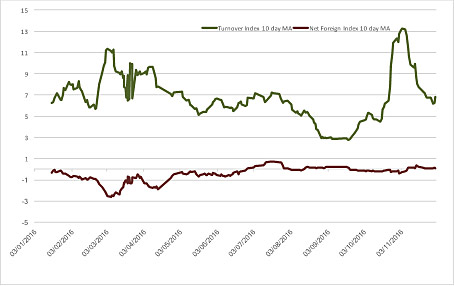

AFC Iraq Fund Class D shares returned +0.5% in November, an underperformance of -2.7% vs. the Rabee RSISX USD Index (RSISUSD) which returned +3.2% in USD terms. The fund has underperformed the RSISUSD by -2.9% since inception. The fund was set to return about 4.3% but lost most of that due to a technical sell-off in a top 5 holding at the end of the month. The courts mandated that North Bank, a bank that is being unwound, liquidate its holding of 1.1 billion shares of Asiacell (TASC), valued at the time of announcement at about USD 4.8 m, in an auction in December to satisfy debts of a creditor. The news turned a +7.5% rise in the month for TASC into a -20% decline in the last 3 days of the month. Such a large holding by any bank is highly unusual and was acquired by North bank in TASC’s USD 1.25 bn IPO in January 2013 valued then at USD 16.9 m. Given, the large size of the auction at about 4 x average daily turnover for the whole market, the sell-off extended to a lesser extent to other stocks as investors sold them to participate in a great bargain due to the forced sale. However, the auction was suspended in early December as TASC claimed a higher priority as a creditor to North Bank while the courts reviewed the different claims. It was eventually decided that the auction will be held in mid-December and the proceeds deposited into an escrow account while the courts decide the merits of the competing claims. However, the price and nature of auction was not decided, i.e. if all the shares would be offered at market prices or that the courts would decide on a price. The market picked up steam and TASC rallied 20% when the auction was suspended but the sell-off, esp. in TASC, resumed after its re-instatement. This phenomenon takes place on the ISX in the event of large IPO or some large rights offerings and tends to happen in other regional markets that are retail investor driven. This is viewed as an attractive buying opportunity to acquire more shares in TASC and other stocks as TASC and the market to a lesser extent would be under pressure until then. The 40 days leading up to 21st November constitute the annual Arba’een pilgrimage, in which this year an estimated 20 million, including 3 million foreign, Shia pilgrims took part. Pilgrims descend, on foot, to Karbala to commemorate the 40th day of the martyrdom of Iman Hussein on 10th October 680, which was a crucial bifurcation point in the Shia-Sunni divide. Life all but came to a halt in the last ten days of the Arba’een and trading slowed down on the Iraq Stock Exchange (ISX). However, the market’s action was a subdued version of the change in tone started in the previous month. Local retail investors still dominated and continued to trade in and out of low-priced, low-quality but high beta stocks, resulting in patterns of higher lows and higher highs. This environment is positive for the sustainability of the upturn in this retail-dominated market which is still suffering a shortage of liquidity. Foreigners seem to be tip-toeing into the market with almost zero sells. Small institutions are buying, and importantly there is a return of individual foreign investors directly on the ISX after a long absence (see chart below). The progress of the battle for the liberation of Mosul continues to be better than expected, supporting confidence, while civilian casualties are mercifully far less than feared, and crucially, sectarian tensions have not materialized. While the battles have reached the city of Mosul and are changing into intense street fighting resulting in increased casualties, ISIS is resorting to indiscriminate shelling of liberated civilian areas. The scorched earth policy of ISIS probably indicates that it is accepting an inevitable loss. Moreover, such brutality in retreat following its savage two-year rule ensures that neither it nor another offshoot will find the same fertile ground that enabled its initial expansion and occupation. While the campaign is by no means over, and increased casualties are likely as the battle progresses, the overall progress is an encouraging indication of the end of ISIS. Turnover on the Iraq Stock Exchange (ISX) vs net foreign trading The economic benefits post-conflict should be significant with the reallocation of military spending to the local economy and the far-reaching investment cycle to rebuild and eventually create prosperity as a long-term solution to the crisis. Ultimately, this could be the catalyst for a new bull market in the Iraqi equity market. However, it will likely be in fits and starts with plenty of “zig-zags” along the way as liquidity is still scarce. Also, foreign institutional investors are still absent. However, a change of direction is at hand with the opportunity to acquire attractive assets that have yet to discount a sustainable economic recovery. Crucially, the Iraq investment story is more real this time than it was at the height of international interest in Iraq in 2012-2014 as a result of the vastly improved local and regional political landscape. The fall of Mosul and a third of the country in June 2014 to ISIS was a major factor behind the brutal bear equity market over the last two years. The double whammy of the cost of war and collapse in oil prices battered the economy and led to a market decline of around 68%, as measured by the Rabee Securities' RSISUSD Index, from the January 2014 Peak to the May 2016 bottom. The last leg of the decline, i.e. the first five months of 2016, was relentless especially after oil prices hit multi-year lows in late January 2016 with persistent local and foreign selling, including the liquidation of a major Iraq dedicated equity fund. The last leg was so savage that it accounted for over a third of the total decline from the peak in 2014. Plus, it was in sharp contrast to the rallies of +84% and +36% respectively in oil prices and Iraq’s Euro Dollar Bond (USD 2.7 billion, issued 2006, due 2028 with a 5.8% coupon) by the end of May after hitting multi-year lows in January. The historical correlation however, reasserted itself with a sharp bounce in June followed by a period of consolidation during the summer months and a sharper bounce in October. As of the end of November, oil prices and the bond are up +36.3% and 17.6% respectively YTD vs. the market, as measured by the RSISUSD Index, down -21.0% YTD. The correlation could suggest plenty of room for the market to catch up on top of considering the expected discounting of an economic recovery post-conflict (see chart below). Rabee Securities’ RSISUSD Index (green), The AFC Iraq Fund outperformed the market since launch until a few months ago, especially in the last leg of the market's decline, yet the same attributes that helped it outperform were behind its underperformance during the market's initial recovery phase characterized by sharp rallies in lower priced and lower quality but high beta stocks. However, this should dissipate as high-quality stocks resume market leadership as part of the market bottoming and eventual recovery process. The fund's holdings are high-quality companies whose earnings power, assets, and franchises held up well during the last two years and the growth in their earnings and asset values is expected to outpace the economic recovery post-conflict which should lead to a sustainable long-term out-performance of the market by these companies. As of 30th November 2016, the AFC Iraq Fund was invested in 14 names and held 1.6% in cash. As the fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq, the countries with the largest asset allocation were Iraq (97.3%), Norway (2.3%), and the UK (0.4%). The sectors with the largest allocation of assets were financials (55.7%) and consumer staples (25.8%). The estimated trailing median portfolio P/E ratio was 10.73x, the estimated trailing weighted average P/B ratio was 0.93x, and the estimated portfolio dividend yield was 2.36%. For more information about Asia Frontier Capital’s Iraq Fund, please click the following links: If you would like to receive the updated factsheets and presentations automatically attached to an email, please drop a line to AFC Vietnam Fund - Manager Comment November 2016

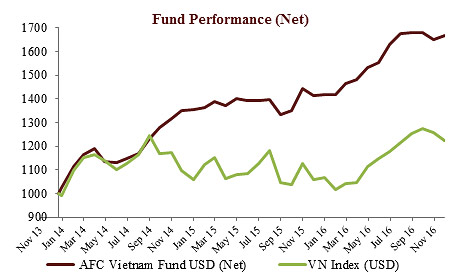

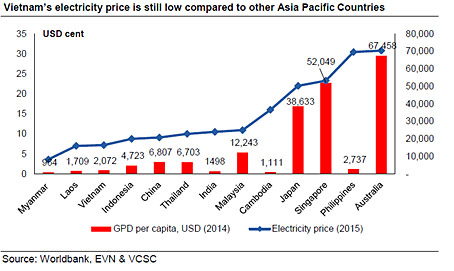

The AFC Vietnam Fund returned +0.9% in November with an NAV of USD 1,665.29, bringing the YTD net return to +17.4% and the net return since inception to +66.5%. This represents an annualized return of +18.5% p.a. By comparison, the November performance of the Ho Chi Minh City VN Index was down -3.1%, while the Hanoi VH Index decreased by -3.4% (in USD terms). Since inception, the AFC Vietnam Fund has outperformed the VN and VH Indices by +44.8% and +56.6% respectively (in USD terms). While emerging and frontier markets are still digesting the big moves in bonds and currencies over the past couple of weeks, which triggered large outflows, especially in ETFs, the AFC Vietnam Fund enjoyed one of its best months in terms of new money inflows. The interest in Vietnam’s market is still unscathed with many new IPO’s coming to market. For example, Construction Joint Stock Company No. 1 (PC1), a key player in power construction, was listed on the Ho Chi Minh Stock Exchange on 16th November. The stock price surged to a peak of VND 49,050 per share before correcting to around VND 36,500 per share. Based on its dominant market share, strong revenue growth, and the government’s plan to triple power capacity over the next 15 years, the stock is trading at 11.0x P/E and 1.4x P/B. PC1 is a leader in the field of constructing power transmission lines and substations in Vietnam with 50 years of experience. Its key businesses include construction of transmission projects, substations, electrical steel tower production and hydro power plant construction and operation. In 2015, total revenue of PC1 hit a record high of VND 3,101 billion, of which power construction contributed 75%, steel tower manufacturing 21% and other activities 4%. Huge potential industry outlook Vietnam’s electricity tariffs are only about half of its regional peers and belong to the most attractive power prices in Asia Pacific. With a GDP per capita of slightly more than USD 2,000, electricity prices in Vietnam are approximately 8 USD cents per kWh. The Philippines for example, with a 30% higher GDP per capita, has an electricity price which is almost 4x higher.

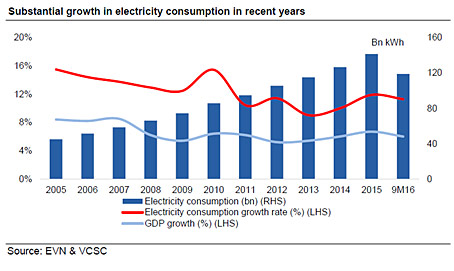

Along with Vietnam’s strong economic growth, electricity demand has also increased substantially over time. Electricity consumption saw stable growth of 10%-12% per annum over the past five years and it is expected to grow at a rate of 10% over the next decade.

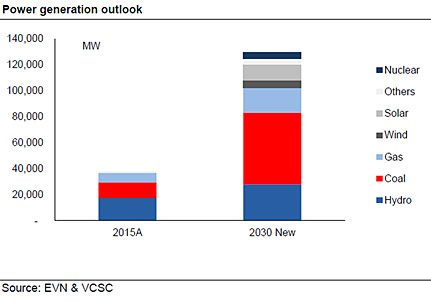

According to the Power Development Program VII, the total capacity in the power sector is expected to triple by 2030. In particular, capacity for hydro plants is estimated to increase 59% while capacity for gas and thermal coal is set to soar by 3x and 5x, respectively. Thermal power will be the key source of Vietnam’s power supply by 2030 and its huge coal reserves are expected to meet Vietnam’s surging demand for more than a century.

A few days ago, the Ministry of Industry and Trade signed an investment agreement with Marubeni from Japan and KEPCO from South Korea, for a USD 2.3 billion thermal power project under the build-operate-transfer (BOT) format. The power plant will be located in Thanh Hoa Province’s Nghi Son Industrial Zone, and will have a total capacity of 1,200 MW, including two 600 MW generators running on coal. The project is among Vietnam’s largest BOT thermal power projects and is a part of the long-term power development master plan. Economy Most macroeconomic numbers in November were fairly stable and within expectations, with the exception of the currency which was driven by the US election results. Domestic consumption: Retail sales of goods and services rose 9.5% YoY (7.6% in real terms) to USD142.3 billion, compared with 8.3% YoY in Nov 2015. Industrial production: The accumulated index of industrial production rose by 7.3% YoY vs. an increase of 9.9% YoY in Nov. 2015. Trade: Vietnam recorded a trade deficit of USD400 million in November, but the YTD trade surplus is still USD2.8 billion. Foreign direct investment: Disbursed FDI continued to grow by 8.3% YoY to USD14.3 billion. The leading sector was manufacturing and processing. Inflation: The Consumer Price Index rose 0.48% MoM and 4.5% compared to the end of 2015. CPI of the transportation sector posted the highest rise among 11 sectors in the CPI basket. According to many polling and election experts, people were voting for Trump because they wanted a change and that was also the biggest fear of the financial markets. But so far, his new cabinet is filled with billionaire bankers (mostly Goldman Sachs) and lawyers. Sen. Elizabeth Warren calls Steve Mnuchin, Trump's pick for Treasury Secretary, “the Forrest Gump of the financial crisis.” It is interesting to note however that the sectors with the largest gains on the US stock market TTD (Trump to Date) have been pharmaceuticals and financials, or in other words, the old business establishment. Maybe, just maybe, the voters will see one day, that Trump is not the President they voted for. Though, for investors this means that still quite a few things will change, but overall it does not have to be negative. For countries with an open mind regarding bilateral trade negotiations, such as Vietnam, it could mean even bigger opportunities if their politicians are smart enough. Trade and economic activity will not stop, but it will most likely shift. Of course, there will be winners and losers and we are quite optimistic at this stage that Vietnam will be among the winners. At the end of November, the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (2.7%) – a manufacturer of electrical and telecom equipment, Agriculture Bank Insurance JSC (2.6%) - an insurance company, Vietnam Livestock Corp (2.2%) – an animal feed and food processing company, Bao Viet Securities JSC (1.9%) – a securities brokerage company, Vietnam Sun Corp JSC (1.6%) – a travel services company. The portfolio was invested in 83 names and held 4.4% in cash. The sectors with the largest allocation of assets were consumer goods (33.9%) and industrials (25.2%). The fund’s estimated weighted average trailing P/E ratio was 9.46x, the estimated weighted average P/B ratio was 1.56x and the estimated portfolio dividend yield was 6.59%. The broad diversification of the fund’s portfolio resulted in a low volatility with a standard deviation of 9.32%, a Sharpe ratio of 1.92 and a correlation of the fund versus the MSCI World Index USD of 0.33, all based on monthly observations since inception. For more information about Asia Frontier Capital’s Vietnam Fund please click the following links: If you would like to receive the updated factsheets and presentations automatically attached to an email, please drop a line to AFC Travel Report – PakistanIn line with our process of being on the ground in the countries we invest in, Thomas Hugger, CEO of Asia Frontier Capital and Fund Manager for the AFC Asia Frontier Fund, travelled to Pakistan last month to attend an investor conference and independently conduct company visits. I had the opportunity in early October 2016 to attend a three-day fund manager conference organized by one of our Pakistani brokers in Lahore (one day) and two days in Karachi, followed by my own visits to some of our investee companies and a number of promising companies pinned down by our research efforts. My last trip to Pakistan was nearly 4 years ago and this conference was a good opportunity to see as many as 19 companies in the country itself and to meet with their senior management. Obviously, my wife was not exactly thrilled when I told her about this upcoming trip since there is negative news about security issues in Pakistan more or less every week in the international press. However, this is only one side of the story and being on the ground in Pakistan gives a different impression than what is usually portrayed in the media. This is the reason why we have been able to find some of our best performing stocks for the fund over the past few years as many well-known and well established companies with good track records have simply been ignored because of the surrounding “noise.” Organizing this trip was already a little bit of a challenge since major Asian airlines such as Cathay Pacific, Singapore Airlines and even Malaysian Airlines stopped servicing Pakistan despite its population of some 180 million+ people. Even Pakistan International Airlines stopped flying to Hong Kong despite the fact that about 40,000 Pakistanis are living there. Fortunately, Thai Airways continues servicing Pakistani cities including Islamabad, Karachi and Lahore. When I was waiting in Bangkok at the gate to board the Boeing 777 aircraft to Lahore, I was basically the only non-Asian passenger, and a Chinese businessman who has a motorcycle production plant in Lahore asked me if I really intended to visit the city since he had never seen a Western face on this particular flight despite taking it once a month for several years. Once seated in the plane it became rather obvious that the front half of economy class was mainly occupied by Pakistani travellers and the back half of economy class (where I was seated) mainly by Chinese workers. Our flight arrived in Lahore late at night. Immigration went quickly and smoothly and a few minutes later I was on my way to the hotel by taxi. We had to drive through the busy streets of a residential area of Lahore which, with about 10.3 million people, is the second largest city in Pakistan and the capital of Punjab Province, which has 101 million people and is the most populous province in Pakistan. Lahore is also referred to the “City of Gardens”, but unfortunately, I was unable to enjoy much in the way of sightseeing during my less than 24 hours in the cosmopolitan city. The city has a large Christian population and hosts some of the holiest Sikh sites, therefore being a major Sikh pilgrimage site only 24 kilometers away from the border with India. Lahore also used to host the second largest stock exchange in Pakistan but on 11th of January 2016 the Karachi, Lahore and Islamabad Stock Exchanges were merged into the “Pakistan Stock Exchange” (PSX) which is headquartered in Pakistan’s financial capital, Karachi. Interestingly my taxi driver could not take the direct way to the hotel since the road passed by an army installation and foreigners are not allowed to go through the area. When I finally reached the hotel, I had to go through two security checks before entering the fortified Pearl Oriental Hotel. The next day our group (six fund managers from the U.S. and myself) visited five companies in the neighbourhood of the hotel by car. Unfortunately, we did not see any of the beautiful sightseeing spots since they are located in the old city centre, and the companies were all situated in a newer area near the airport. We visited two cement companies (I met two additional cement companies in Karachi which shows the importance of this sector), one piped gas distributer, and one glass manufacturing company. Later in the evening we took a Pakistan International Airlines (PIA) flight to Karachi which was smooth and uneventful. Badshahi Mosque Over the next two days, our group was confined in a meeting room in one of the handful of five star hotels in Karachi and every 90 minutes, senior representatives from nine different listed companies briefed the group about their businesses and their respective outlooks and answered our questions. The companies represented were from the oil & petroleum, cement (of course), media, power, banking, food and fertilizer sectors. The AFC Asia Frontier Fund is currently invested in three of the nine companies I met. It helped me to gain deeper insight into these companies which resulted later in the month (after researching in more detail with our in-house Senior Analyst, Ruchir in Hong Kong) in some portfolio movements (and brokerage fee income for the organizing Pakistani brokerage company). During the first evening, the organizing brokerage company took the participants on a tour around Karachi (mainly Clifton) and I.l. Chundrigar Road (the Wall Street of Pakistan). Despite the darkness, I was able to recognize considerable changes in Karachi, especially in the area “Phase 5” and “Phase 6” where several Hong Kong-style skyscrapers (one of them 65 stories tall) have been built since my last visit nearly four years ago, or were still under construction. Most of these new buildings were for mixed use (office and residential including a shopping mall). After the tour, we had a delicious and relaxing dinner outside in the garden of a French restaurant on the campus of the French consulate. The following 1½ days I was on my own visiting various companies in and around Karachi. Driving around the city can be very chaotic, sometimes dangerous (our car was hit several times by motorbikes and three wheelers but our driver did not even bother to stop and check the resulting damage) and at times very picturesque. The roads and highways are shared commonly by motorbikes, bicycles, donkey-drawn carts, three-wheeled taxis or “tuk-tuks”, small vans, cars and especially by beautifully painted trucks and buses. Colorful Bus Transportation in Karachi

Our first meeting on the fourth day was a visit to a car assembly plant located in Port Qasim which is 35 kilometers south east of Karachi. It took us about one hour to reach the entrance to the industrial zone adjacent to Pakistan’s second largest port, and another 30 minutes to find the factory as were got lost several times (even while using Google Maps) due to the size of the industrial park. During the entire trip, I experienced a complete change in the attitude and future business outlook of the senior businessmen compared with my previous visit in Pakistan nearly 4 years ago. During my last trip most of the companies suffered from a severe energy shortage, lack of government support and severe security issues. I distinctly remember meeting one of the sponsors of a major car factory over coffee and his complaints over falling monthly car sales without any possible turnaround in sight. That has all changed since Nawaz Sharif was elected as the new Prime Minister in June 2013. Some of the local car assembly factories are now operating at over 110% capacity! The major buzz word during my visit was “CPEC” which stands for “China-Pakistan Economic Corridor” and is a collection of projects, many of them already under construction, in the amount of at least USD 51 billion financed by the Government of China, Chinese banks or Chinese companies. The goal of CPEC is to create trade and investments along a route which connects China’s most western city Kashgar with Gwadar in the South of Pakistan where a major port just started operating a few days ago. Investments will be made in highways, railways, ports, power plants and pipelines. This will rapidly expand and upgrade Pakistan’s infrastructure as well as deepen the historically excellent relationship between China and Pakistan much to the dislike of India, which has already resulted in heightened tensions recently between the two arch rivals. For a businessman in Pakistan, CPEC is obviously fantastic news since he will be able to operate, for example his textile company in the future for 24 hours/7 days a week compared with maybe a maximum of14 hours a day (due to a cut in power supply) just a few months ago. Needless to say, this expansion will create new jobs, additional investment, and capacity upgrades, which will attract more foreign investment down the road after already reaching USD 2.6 billion in 2015. We at Asia Frontier Capital believe that CPEC could be THE “game changer” for Pakistan and therefore we have already positioned our Pakistani equity portfolio in the AFC Asia Frontier Fund towards companies benefitting from CPEC immediately and from future increased investments in the country. Another additional “boost” for the Pakistani stock market will be the inclusion of Pakistan in the MSCI Emerging Market Index as of June 2017, which will lead to an estimated inflow of around USD 500 million from passive emerging market funds into the bourse which is trading at an estimated forward P/E of just 9.7x. What a change compared with my last visit to Pakistan at the end of 2012, when I ended my travel report with the sentence, “despite problems on Pakistan's surface, the visit made it clear to me that a contrarian investor looking in the right places can find lucrative stocks and attractive sectors in the country!” I am very excited to be visiting this completely misunderstood country again in 2017 to witness its economic and social progress.

|

|||||||||||||||||||||||

|

From all of us at Asia Frontier Capital, we hope that you have enjoyed reading this newsletter and we would like to wish you and your family a Merry Christmas and all the best for a happy and profitable 2017! With kind regards, Thomas Hugger |

||||||||||||||||||||||||

|

Asia Frontier Capital Limited |

||||||||||||||||||||||||

Disclaimer:This Newsletter is not intended as an offer or solicitation with respect to the purchase or sale of any security. No such offer or solicitation will be made prior to the delivery of the Offering Documents. Before making an investment decision, potential investors should review the Offering Documents and inform themselves as to the legal requirements and tax consequences within the countries of their citizenship, residence, domicile and place of business with respect to the acquisition, holding or disposal of shares, and any foreign exchange restrictions that may be relevant thereto. This newsletter is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law and regulation, and is intended solely for the use of the person to whom it is intended. The information and opinions contained in this Newsletter have been compiled from or arrived at in good faith from sources deemed reliable. Opinions expressed are current as of the date appearing in this Newsletter only. Neither Asia Frontier Capital Ltd (AFCL), nor any of its subsidiaries or affiliates will make any representation or warranty to the accuracy or completeness of the information contained herein. Certain information contained herein constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of Funds managed by AFCL or its subsidiaries and affiliates may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is not necessarily indicative of future results. © Asia Frontier Capital Ltd. All rights reserved. The representative of the funds in Switzerland is Hugo Fund Services SA, 6 Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of performance and jurisdiction for Shares in the Fund distributed in Switzerland are at the registered office of the Representative. AFC Asia Frontier Fund is registered for sale to qualified /professional investors in Japan, Singapore, Switzerland, the United Kingdom and the United States. AFC Iraq Fund in Singapore, Switzerland, the United Kingdom and the United States. AFC Vietnam Fund in Japan, Singapore, Switzerland and the United Kingdom. By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions. |

||||||||||||||||||||||||

GO TOP |

||||||||||||||||||||||||