Asia Frontier Capital (AFC) - February 2015 Newsletter |

|||||||||||||||||||||||||||||||||

In this IssueAFC Asia AFC Vietnam Fund

|

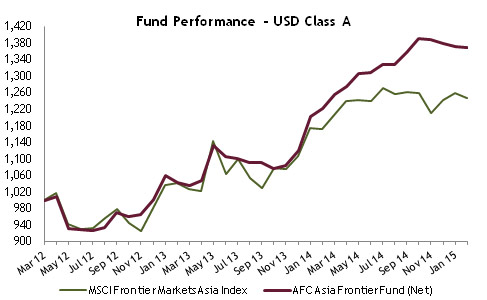

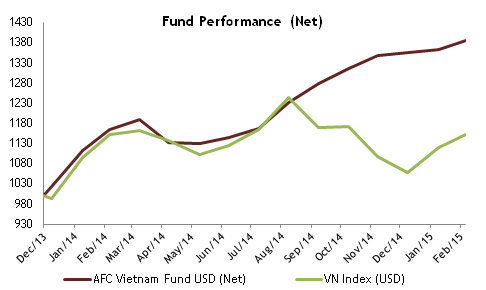

"Challenges are what make life interesting and In February 2015, the AFC Asia Frontier Fund returned –0.3% and the AFC Vietnam Fund returned +1.8% bringing returns since inception to +36.9% and +38.6% respectively. The MSCI Frontier Asia Index (-1.0%) saw a slide as there was selling pressure in the heavily index-weighted Pakistan. At the same time the MSCI Frontier Index (+2.9%) and MSCI World Index (+5.7%) saw significant rallies. In Vietnam, there was an upward movement in the markets lead by a rally in the banking sector with the Ho Chi Minh VN Index (+2.9%) and Hanoi VH Index (+0.3%) ending the month up. Looking around the world there have been several developments that could lead to some market movements in 2015. Last month there was positive economic news out of the US after the latest unemployment figures were released. The unemployment rate dropped to 5.5% which is the lowest it has been in the US since May 2008. With the continued low oil price keeping money in consumers’ pockets and helping to keep inflation in check, this could potentially be a catalyst to see 2015 become the year that the US Federal Reserve finally stops tapering and raises interest rates. With this in mind, it is important to ensure that your portfolio in 2015 contains assets that will be more resilient to market volatility or downturns should there be an economic shock from rising interest rates in the US. The easiest way to do this is through diversification into asset classes that have low correlations with each other. The AFC Asia Frontier Fund has maintained its low correlation to the MSCI World Index and MSCI Emerging Markets Index of only 0.27 and 0.24 since inception and we have previously seen similarly low numbers when running them against other asset classes (such as US real estate). It may also be surprising to find out that since the first announcement of tapering, in May 2013, the correlation has been negative with the MSCI World Index and MSCI Emerging Markets Index standing at -0.26 and -0.24 respectively. For a flashback to Thomas Hugger’s CNBC interview on this topic from August 2013, please click here. Speaking with our clients, our funds are becoming increasingly popular as a means to diversify clients’ overall portfolios. There have also been continued investment inflows this month and we would like to extend a warm welcome to all of our new investors. AFC News

AFC wins Fund Awards! AFC is pleased to announce that the AFC Asia Frontier Fund and AFC Vietnam Fund have won the following awards from BarclayHedge:

Upcoming AFC TravelIf you have an interest in meeting with our team during their travels, please contact our Marketing Director Stephen Friel at

AFC Asia Frontier Fund - Manager Comment

AFC Asia Frontier Fund (AAFF) USD A-shares returned -0.3% in February 2015, outperforming the MSCI Frontier Asia Index (-1.0%) whilst underperforming the MSCI Frontier Index (+2.9%) and MSCI World Index (+5.7%). It was a soft month for AAFF. Bangladesh continues to grapple with a tense political environment and this is expected to impact the economy in the first half of 2015. However, the fund’s consumer related holdings did fine given the situation on the ground. The impact of the political blockades will probably be reflected when this quarter’s results are announced in April but we continue to like the longer term consumption story in Bangladesh and therefore will look to build positions in consumption related stocks we like if there is a correction. The Pakistan market took a bit of a breather given the run up over the past few quarters in the light of positive triggers such as lower oil prices and an interest rate cut. We think the impact of lower commodity prices should be reflected in companies’ results in the first half of 2015. The fund initiated a position in a motorcycle company in Pakistan, as this company has a leading positon in the market and has performed consistently over the long run. We think the company has shown less susceptibility to profit volatility compared to its peers in the four-wheeler industry given that the auto industry in Pakistan is heavily dependent on imported components which expose the industry to exchange rate risk. In Sri Lanka, the market saw a recovery led by the banking sector post the Presidential elections in January, but certain infrastructure related stocks in the cement sector continued to underperform due to a combination of not-so-good results as well as uncertainty over infrastructure projects in the country. This impacted AAFF’s returns from Sri Lanka during the month. With Parliamentary elections scheduled for April, some amount of uncertainty could creep into the market until then. Vietnam witnessed banking stocks rally, as there is a feeling that economic growth this year and going forward can help the sector recover from the problems it has faced over the past few years. The fund does not hold any banks at the moment but initiated positions in three new non-financial companies during the month based on our visit to the country last month. We think with the economy picking up pace, cyclical stocks can deliver returns and therefore our three new investments are all infrastructure-related, either directly or indirectly. The best performing indices within the AAFF universe in January were Vietnam (+2.9%), followed by Sri Lanka (+1.7%) and Bangladesh (+0.8%). The poorest performing markets were Iraq (-18.2%) and Cambodia (-5.8%). The top-performing portfolio stocks were a Mongolian retail chain (+26.9%), followed by two Mongolian copper exploration companies (each +25.0%) and a Bangladeshi consumer product company (+22.9%). In February we added to existing positions in Bangladesh, Laos, Mongolia, Pakistan, Papua New Guinea, Sri Lanka, and Vietnam. We added two cement companies and a consumer/industrial lighting company as new positions in Vietnam and one Pakistani motorcycle company. We also partially sold a small position in a Sri Lankan holding company and exited entirely the Vietnamese closed-end fund. As of 28th February 2015, the portfolio was invested in 122 shares and held 6.5% in cash. The two biggest stock positions are a pharmaceutical company in Bangladesh (4.6%) and a shoe retailer in Bangladesh (3.7%). The countries with the largest asset allocation include Vietnam (26.3%), Pakistan (19.9%) and Bangladesh (14.5%). The sectors with the largest allocation of assets are consumer goods (41.7%) and materials (14.2%). The weighted average trailing portfolio P/E ratio (only companies with profit) was 13.67x, the weighted average P/B ratio was 1.61x and the dividend yield was 3.77%. AFC Vietnam Fund - Manager Comment

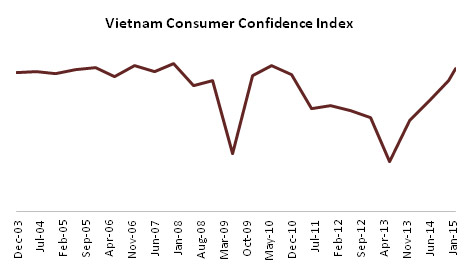

To read this month’s fund update in German please click here. In February 2015 the AFC Vietnam Fund returned +1.8%. The main event impacting the Vietnamese market last month was undoubtedly the Chinese New Year and Tết holidays which saw domestic trading halted for more than one week. This short trading month was characterized by very low stock market volumes. Overall we saw a continuation from January, where notably banking stocks and some individual companies were mainly responsible for the index movements. Compared to the end of January the AFC Vietnam Fund therefore saw again quite different movements against the indices. The Ho Chi Minh index performance was very strong to end the month up +2.9%, while the Hanoi index, which is more relevant to our fund, finished the month almost unchanged with a return of +0.2%. The holiday period is usually connected to higher inflation rates but this year it was virtually non-existent as it came in only slightly above zero on a year-on-year basis. The risk of deflation in Vietnam is minimal in contrast to other countries and inflation will most likely not be a big theme in 2015. This should allow the government some flexibility with regard to fiscal and monetary policy which could see, for example, an increase in electricity prices at the same time as a continuation of the low interest rate environment. Other relevant economic indicators all remain positive at this stage and the important consumer confidence index managed to continue its uptrend during the first two months of this year.

Meanwhile the 2014 reporting season has almost come to an end and we generally see a mixed picture. Due to the diversified nature of our portfolio holdings, aimed at minimizing concentration and corporate governance risk, the results of individual companies are not as critical to our performance as opposed to other more concentrated funds. In the AFC Vietnam Fund the top 5 positions make up less than 15% of the portfolio whilst some other funds can see their largest 5 holdings weighted up to 50% or sometimes even higher. It is therefore all the more pleasing, that the estimates for revenues and profits for the 160 companies which we are currently tracking deviated by only 2% and 0% on average respectively. The average median profit increase of these companies in 2014 was +10%, which is higher than the overall market. As a result of this reporting season, we are rebalancing our portfolio and taking advantage of some new investment opportunities which we expect to be very beneficial for our investors in 2015. Looking ahead in 2015 we are expecting further valuation adjustments of smaller companies. This revaluation, as seen in recent years, typically happens periodically in strong bursts like in the spring and autumn of 2014. Historically there are many examples of an outperformance of smaller companies during the first years of an economic recovery, as seen most recently in the 6 year-old bull market in the USA.

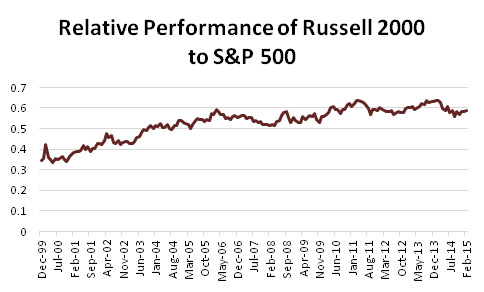

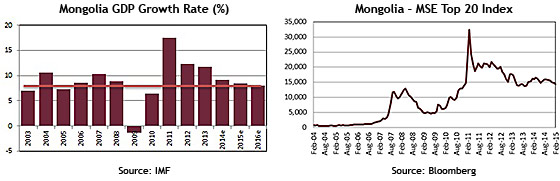

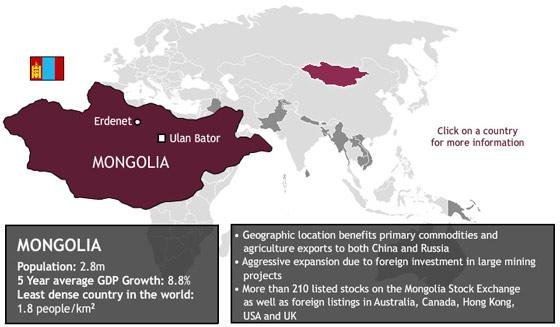

The well-diversified Russell 2000 index demonstrates quite nicely that only in the late stage of economic recoveries larger companies start performing better than small caps - at a time where smaller companies are already much more expensive on a relative basis than large caps. We expect this situation to also play out in Vietnam and therefore in the future our strategy will slowly shift into larger caps when small caps are no longer undervalued. Until this happens, however, we still see much further potential in Vietnamese small caps and we aware of the fact that in Vietnam there is the "danger" that speculative Vietnamese retail investors will push up smaller and optically cheaper companies way above realistic valuations. In February, the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (5.7%) - a manufacturer of electrical and telecom equipment, Thuan An Wood Processing JSC (2.7%) – a household furniture manufacturer, FLC Group JSC (2.4%) – a real estate development company, SPM Corp (2.2%) – a pharmaceutical company and Foreign Trade Forwarding and Transportation JSC (2.2%) – a freight forwarding company. As of 28th February 2015 the portfolio was invested in 72 shares and held 2.7% in cash. The sectors with the largest allocation of assets were consumer goods (35.8%) and industrials (23.0%). The fund’s weighted average trailing P/E ratio was 7.74x, the weighted average P/B ratio was 1.10x and the average dividend yield was 5.76%. AFC Country Snapshot: MongoliaAlthough it is the least densely populated country in the world, with less than 3 million people living in a land area of 1.5 million km2, Mongolia has the potential to see the greatest growth of any country within the AFC Asia Frontier Universe. Mongolia’s economy is traditionally based on herding and agriculture, but is expanding aggressively due to foreign investments in large mining projects that capitalize on the country’s vast deposits of coal, copper, gold, tungsten, tin, nickel, zinc, silver, and iron. Real GDP is expected to expand by 8.4% in 2015 and this should accelerate sharply if the government can resolve an ongoing dispute with a large foreign mining company. Mongolia’s growth is also steered by high levels of agricultural production and the spill-over from China’s epic growth.

Stock Market: The Mongolian Stock Exchange (MSE), located in Ulan Bator, is the country’s sole stock exchange. The history of MSE’s securities market began between 1992-1995 when 475 state owned entities were successfully privatized through MSE distributing 96.1 million shares worth 8.2 billion MNT (7.0 million USD) to the citizens of Mongolia within the framework of implementing “Privatization Policy” of the Mongolian Government during the transitional period of a central planned economy to a market economy in Mongolia. Secondary market trade began on August 28, 1995 auctioning 16,000 shares of three companies that valued 15,000 USD. The MSE now lists 212 companies and has a market capitalization of USD 700 million as of February 2015. Mongolian Stock Exchange website: www.mse.mn

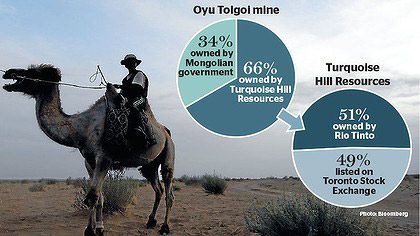

Country snapshots for all of AFC's markets can be found on our website at www.asiafrontiercapital.com AFC Country Report: MongoliaThe key topic that will continue to dictate investor confidence in Mongolia is the issue of Oyu Tolgoi, the USD 6 billion copper and gold mine that has become the focal point of a well-publicized dispute between Turquoise Hill Resources (a subsidiary of mining giant Rio Tinto), which owns 66% of the mine, and the Mongolian government, which owns 34% of the project. Hailed as a transformational discovery that would account for more than one-third of Mongolia’s GDP upon completion, the project has become a litmus test for foreign investment in the country, with many outside observers expressing worry over the ongoing disagreements between the two joint venture partners regarding profit sharing and financing. Mongolia’s new Prime Minister Chimed Saikhanbelig has tried to revive foreign investment in the wake of the Oyu Tolgoi dispute and several other incidents involving backtracking on mining licenses and changing foreign investment laws. He has proposed an amendment to the minerals law to allow the government to swap its ownership stake in the Oyu Tolgoi project in exchange for future royalty payments from mine developers. The amendment would mean that the Government of Mongolia would be off the hook for providing a significant amount of the USD 5 billion necessary for the construction costs of Phase Two of Oyu Tolgoi, which would help develop the underground portion of the mine, which contains 80% of the deposit’s total value. Rio Tinto, however, does not want to increase its ownership percentage in the project by buying the Government’s stake, especially in light of the fact that global commodity prices are down – in January, copper fell to its lowest price since the 2008 global financial crisis.

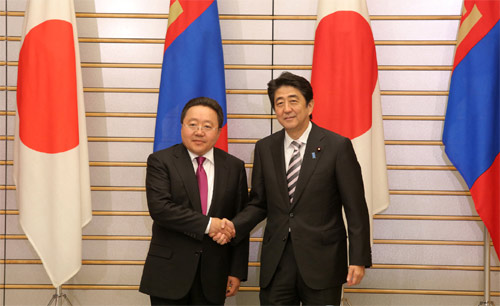

One potential glimpse of hope for foreign investors watching the Mongolia situation came in early March when an international tribunal ordered the Government of Mongolia to pay USD 100 million to Canada-based Khan Resources in compensation for cancelling the company’s uranium mining licenses granted in 2009. Khan’s shares jumped +28% on the news, and the court ruling is hopefully a signal of a move towards better enforcement of laws, contracts, and agreements in the country between the government and foreign companies. More good news came when the government announced its plan to renew the granting of mineral exploration licenses commencing on 26th January 2015 after a more than 5 year hiatus. There may also be signs of hope for continued political reform as the President of Mongolia also pardoned three foreign employees of coal miner SouthGobi Resources Ltd who had been sentenced to over 5 years in prison for tax evasion. The foreigners had been banned from leaving Mongolia, and the case was plagued by murky details and translation problems, threatening to further derail investor sentiment in the country. Forward progress by the government is vital to coax back foreign investment, as the country’s Central Bank announced in August of last year that FDI entering Mongolia from January to July 2014 had fallen 70% year-on-year to a total of USD 873 million, following a 43% drop during the same period in 2013. Slumping foreign investment has been the main catalyst for Mongolia’s woes, but dipping commodity prices and a weakened currency have also contributed to the country’s slide. Byambasaikhan Bayanjargal, the CEO of Erdenes Mongol, the umbrella company that holds the Mongolian government’s stakes in various mining projects in the country, believes he can transform the outlook for mining projects and foreign investment in the country. Bayanjargal, who previously worked for the Asian Development Bank in project finance and helped manage a USD 120 million wind farm project in the country, wants to raise foreign capital and sell shares in the company to create a “Mongolian Temasek” modeled after the highly-successful Temasek Holdings investment company in Singapore that manages about USD 164 billion on behalf of the Singaporean government. In an effort to diversify the economy away from mining and natural resources, Mongolian lawmakers voted in February to allow the construction of casinos in the country to try and capture some of the Asian gaming market share from its traditional hub, Macau. The proposed law would seek to attract wealthy gamblers from China, Russia, and Japan, while banning gambling for local citizens. The law would enable two casinos to be built in a public-private partnership and would provide a boost for government tax revenues and the slumping economy. On the political front, Mongolia has become an increasingly important part of Japan’s foreign policy, as Tokyo seeks to counter Beijing’s influence in Asia’s frontier markets and develop stronger ties with countries that have historically enjoyed cozy relationships with China. Similar calculus has been employed by Japan in building ties and substantially increasing investment to Myanmar, Cambodia, and Laos to provide an alternative to Chinese low-interest financing and also help create markets for Japanese companies to make inroads. Mongolia has also been a useful intermediary for Japan for dealing with North Korea, acting as a diplomatic conduit for talks between the two nations after the kidnapping of several Japanese by Pyongyang decades ago. Ulaanbaatar maintains relations with Pyongyang, and hosted three rounds of bilateral talks on the kidnapping issues between delegates of Pyongyang and Tokyo from 2007-2012, receiving praise from the Japanese media. Mongolia’s neutral policy towards both North and South Korea has helped Ulaanbaatar broaden its geopolitical ties and hedge the risk of any potential future disputes with China or Russia.

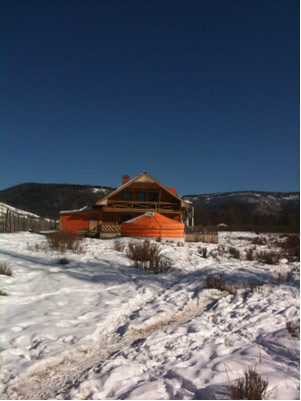

Mongolia and Japan signed several free-trade agreements in February, as Japan seeks to find an alternate supplier than China for rare earths minerals used in the production of automobiles and high-tech products. Mongolian imports from Japan (primarily automobiles) dwarf its exports (mainly coal and rare earths minerals), but for a niche sector, Mongolian cashmere, the February talks were noteworthy due to the announcement of a call for tariffs on cashmere to be scaled back by Tokyo. Another aspect of the agreement was Japanese Prime Minister Shinzo Abe’s announcement that Japan would offer USD 308 million in financing to help build the New Ulaanbaatar International Airport (NUBIA), which is slated to be completed in late 2016. NUBIA has been mentioned as a potential location for any future casino that Mongolia might build, and the airport will have a capacity of up to 3 million passengers a year, with cargo capacity set to increase ten-fold. AFC Travel Report: MongoliaIn line with our process of being on the ground in the countries we invest in, AFC's regional research analyst Scott Osheroff, recounts some of his experiences from his travels to Mongolia in February 2015. This trip I was on a fact-finding mission, surveying the current state of the economy while meeting with several publicly listed companies on the fledgling Mongolian Stock Exchange to assess potential investment opportunities for the AFC Asia Frontier Fund. An old Soviet city with pockets of modernity, Ulaanbaatar is an outpost for the adventurous and enterprising who are willing to bear the cold winters in one of the most remote parts of the world to try to capture the potential rewards. On my first morning I decided to brave the cold and go for a stroll in the then -27 Celsius weather to see what had changed since my last trip in June 2014. Heading west past the Olympic Residence, under construction by Asia Pacific Investment Partners, and the Children’s Park where the Shangri La Hotel is being built, it was interesting to see so many cranes hovering over the city. At one point I stopped and turned 360 degrees counting nine cranes. The capital inflows into Mongolia in the later 2000’s and following government stimulus led to a building boom with many projects now in limbo. Construction woes were the least surprising; I was flabbergasted by how few foreigners were now in the city, even with the expat winter migration that usually happens this time each year. Once a darling of the frontier markets investment community, and briefly the fastest growing country in the world, a mass exodus of foreign talent began in 2012 when several unfriendly FDI policies coincided with a correction in commodities markets. The result is a nascent community of long-term expats who are largely entrepreneurs or who have local families. Continuing my walk, around lunch time I escaped the cold, stopping by my favourite Mongolian restaurant downtown which serves a one-of-a-kind beef noodle soup. Once inside and having ordered from memory I took to reviewing the menu while waiting for lunch to arrive. In my utter amazement prices had risen 60% in local currency terms in just six months’ time. The unfriendly FDI policies I mentioned previously have led to significant weakness in the tugrik where the exchange rate has subsided from 1,312 in June 2012 to the current rate of 1,983 versus the USD. This momentous decline has led to sticker price shock and my restaurant had resorted to using sticky notes to update pricing, seeking to avoid menu price costs associated with a continually depreciating currency. This is something I never expected to witness outside of my economic history class from my university days. Onto some positives, in light of the direct harm to the economy that government policies have caused, it seems that the government is slowly learning its lesson. A milestone for the country occurred on 26th January, which was the first time the Government of Mongolia had issued minerals exploration licenses in over five years. As a resource rich economy, mining is arguably the lifeblood of the economy. This change has led to a slow rebirth of interest in the mining industry and resulted in quite a buzz of activity in the local business community, which was refreshing. The following several days I visited prospective investments for the AFC Asia Frontier Fund as well as some existing companies that are already a part of our portfolio. Two companies with the most potential that I met were a confectionary/bakery producer and a construction materials company, the latter not dissimilar to Home Depot in the USA. The confectionary company has broad distribution throughout the north of Mongolia and is in the process of retrofitting a section of its factory to produce ice cream and skim milk powder (SMP). This had piqued my interest as the major Mongolian dairies import SMP from large international groups including Fonterra in New Zealand. The company is also expanding distribution into Ulaanbaatar where they believe they can compete directly with the two largest confectionary/bakery groups in the country.

The construction materials shopping center is an existing investment and one we perceive as a unique way in which to gain leverage to the real estate sector. The company has over 200 stalls which are fully rented to tenants who sell their products, running the gamut from chandeliers to floor tiles. The majority of the tenants have been renting for more than eight years, the company has a “sticky” customer base which allows them to keep vacancies low and raise rents accordingly. Notably, their earnings per share in 2014 grew by 78.6% as expansion plans see them building similar shopping centers in second tier cities whilst they continually improve their existing facility in the capital. In the winter time, Ulaanbaatar is the most polluted capital city in the world, with the burning of coal fires in gers making it significantly worse than Beijing! Thus, on the weekends locals and foreigners alike drive out to the countryside for camping, hiking, and of course skiing. As my trip came to a close I was invited by some friends to go cross country skiing north of Ulaanbaatar, bordering the Siberian forest. Making our way across frozen rivers and through the forest was a splendid and relaxing way to indulge in the serene beauty of Mongolia. This trip also further piqued my interest for the future of the Mongolian tourism industry as, even in winter, it offers experiences unlike anywhere else in the world.

|

||||||||||||||||||||||||||||||||

|

I hope you enjoyed reading our monthly newsletter. If you would like any information about our funds or markets please let me know. With kind regards, Thomas Hugger |

|||||||||||||||||||||||||||||||||

Disclaimer:This document does not constitute an offer to sell, or a solicitation of an offer to invest in AFC Asia Frontier Fund, AFC Asia Frontier Fund (non-US), AFC Vietnam Fund or any other funds sponsored by Asia Frontier Capital Ltd. or its affiliates. We will not make such offer or solicitation prior to the delivery of a definitive offering memorandum and other materials relating to the matters herein. Before making an investment decision with respect to our Funds, we advise potential investors to read carefully the respective offering memorandum, the limited partnership agreement or operating agreement, and the related subscription documents, and to consult with their tax, legal, and financial advisors. We have compiled this information from sources we believe to be reliable, but we cannot guarantee its correctness. We present our opinions without warranty. Past performance is no guarantee of future results. © Asia Frontier Capital Ltd. All rights reserved. The representative of the Fund in Switzerland is Hugo Fund Services SA, 6 Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of performance and jurisdiction for Shares in the Fund distributed in Switzerland are at the registered office of the Representative. By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions. |

|||||||||||||||||||||||||||||||||

GO TOP |

|||||||||||||||||||||||||||||||||